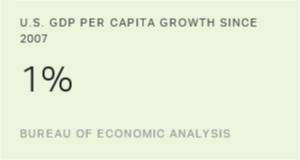

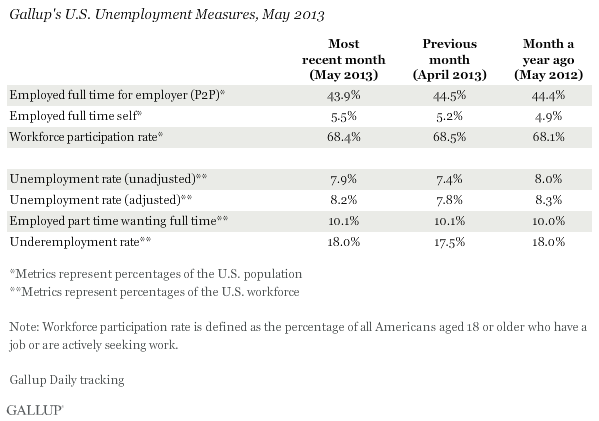

WASHINGTON, D.C. -- The U.S. Payroll to Population employment rate (P2P), as measured by Gallup, worsened in May, dropping to 43.9%, from 44.5% in April. P2P is also down from May 2012, when it was 44.4%

Year-over-year comparisons are helpful in determining the degree to which monthly changes are the result of growth in permanent full-time positions rather than temporary seasonal hiring. The decline in P2P versus 2012 indicates that fewer people worked full-time for an employer this May compared with a year ago. The 43.9% found this May is similar to the 43.7% recorded in 2011 and 44.0% in 2010.

Gallup's P2P metric is an estimate of the percentage of the U.S. adult population aged 18 and older who are employed full time by an employer for at least 30 hours per week. P2P is not seasonally adjusted.

These results are based on Gallup Daily tracking interviews with more than 30,000 Americans, conducted May 1-31 by landline and cellphone. Gallup does not count adults who are self-employed, working part time, unemployed, or out of the workforce as payroll-employed in the P2P metric.

Although P2P is down, the percentage of Americans working full-time for themselves has improved. Full-time self-employment is at 5.5% in May, up from 5.2% in April, and has been consistently greater than 5% every month in 2013, with the highest rates since Gallup began tracking employment in 2010.

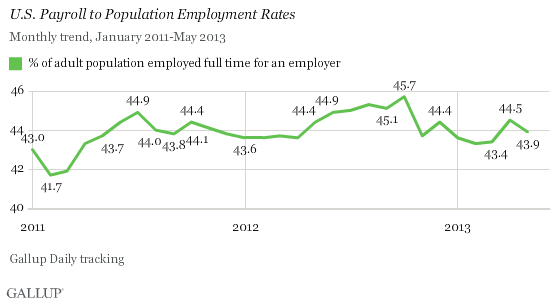

Seasonally Unadjusted Unemployment Ticks Up in May

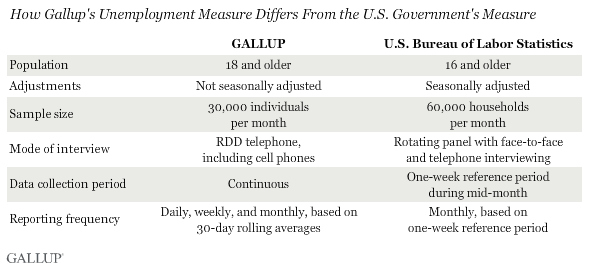

Unlike Gallup's P2P rate, which is a percentage of the total population, traditional employment metrics, such as the unemployment rates Gallup and the U.S. Bureau of Labor Statistics report, are based on the percentage of the workforce. Gallup defines the "workforce" as adults who are working or actively looking for work and available for employment. The U.S. workforce participation rate in May was 68.4%, unchanged from 68.5% in April, but a slight improvement from May 2012 (68.1%).

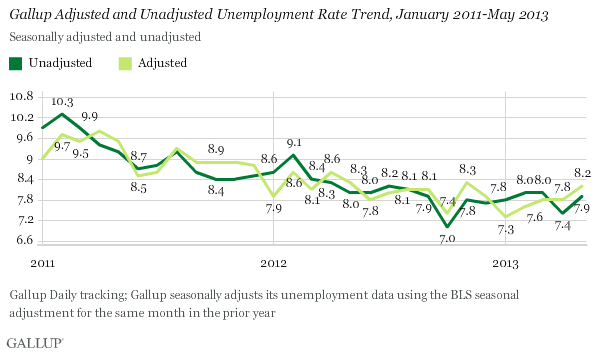

Gallup's unadjusted unemployment rate for the U.S. workforce was 7.9% for the month of May, a half-point increase over April, and statistically unchanged from May 2012 (8.0%).

Gallup's seasonally adjusted U.S. unemployment rate for May was 8.2%, up from 7.8% in April. Gallup calculates its seasonally adjusted employment rate by applying the adjustment factor the U.S. government used for the same month in the previous year. Last year, the government adjusted May's rate up by 0.3 percentage points.

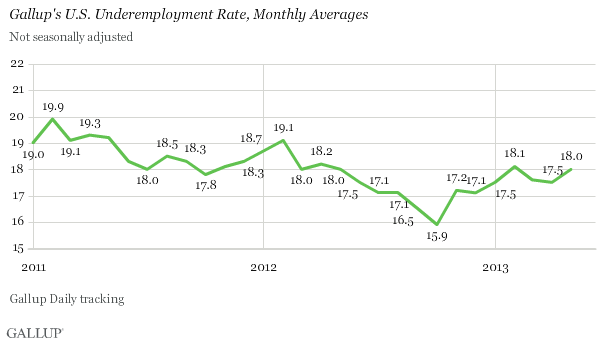

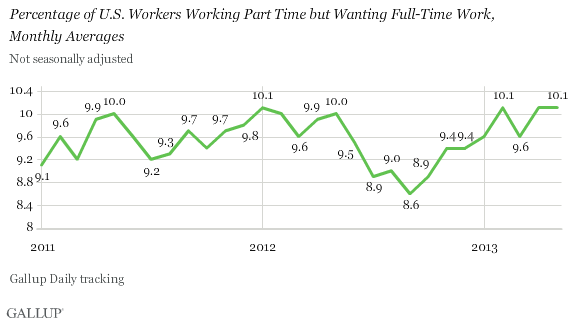

Underemployment, as measured without seasonal adjustment, was 18.0% in May, up from 17.5% in April, but unchanged from May 2012 (18.0%). Gallup's U.S. underemployment rate combines the percentage of adults in the workforce who are unemployed with the percentage of those who are working part time but looking for full-time work.

The increase in underemployment came completely from the rise in the unemployment rate. The percentage of part-time workers wanting full-time work was 10.1%, unchanged from April, and statistically the same as the May 2012 rate.

Implications

The decline in P2P and the increase in unemployment that Gallup finds in May contrasts with the improvements in both seen in April. The strong year-over-year improvements seen in April were not sustained in May, and the size of the workforce, P2P, and unemployment rate are virtually the same as or in worse shape than a year ago.

The one bright spot is the increase in the percentage of self-employed Americans. While P2P experienced month-over-month and year-over-year declines, self-employment increased. This growth is a positive sign and reveals that many of the people who used to work for an employer may have now moved to jobs working for themselves. Entrepreneurial activity can help drive economic growth and create new jobs, but the self-employment rates must be mentioned with a note of caution: If employees are losing payroll jobs and becoming their own bosses out of necessity, these may not be the types of jobs needed to truly improve the economy.

More optimistically, workers may be leaving payroll jobs because they see opportunities to create their own thriving businesses, a risk that might not have been worth it during the height of the recession. Successful entrepreneurial endeavors will create payroll jobs, in turn increasing the P2P rate. Gallup will continue to monitor these numbers in the months and years to come, and the changes in both metrics will be important to watch.

Gallup's seasonally adjusted U.S. unemployment rate -- the closest comparison it has to the official numbers released by the BLS -- increased. The BLS will likely not report a decline in the unemployment rate when its May numbers are released on Friday morning. However, the unemployment rate as reported by the BLS each month does not always track precisely with the Gallup estimate, in large part due to differences in the adjustment procedure the BLS uses, and because of some differences in the way in which data are obtained.

Gallup.com reports results from these indexes in daily, weekly, and monthly averages and in Gallup.com stories. Complete trend data are always available to view and export in the following charts:

Daily: Employment, Economic Confidence, Job Creation, Consumer Spending

Weekly: Employment, Economic Confidence, Job Creation, Consumer Spending

Read more about Gallup's economic measures.

View our economic release schedule.

Survey Methods

Results for this Gallup poll are based on telephone interviews conducted May 1-31, 2013, on the Gallup Daily tracking survey, with a random sample of 31,523 adults, aged 18 and older, living in all 50 U.S. states and the District of Columbia.

For results based on the total sample of national adults, one can say with 95% confidence that the margin of sampling error is ±1 percentage point.

Interviews are conducted with respondents on landline telephones and cellular phones, with interviews conducted in Spanish for respondents who are primarily Spanish-speaking. Each sample of national adults includes a minimum quota of 50% cellphone respondents and 50% landline respondents, with additional minimum quotas by region. Landline telephone numbers are chosen at random among listed telephone numbers. Cellphone numbers are selected using random digit dial methods. Landline respondents are chosen at random within each household on the basis of which member had the most recent birthday.

Samples are weighted to correct for unequal selection probability, nonresponse, and double coverage of landline and cell users in the two sampling frames. They are also weighted to match the national demographics of gender, age, race, Hispanic ethnicity, education, region, population density, and phone status (cellphone only/landline only/both, cellphone mostly, and having an unlisted landline number). Demographic weighting targets are based on the March 2012 Current Population Survey figures for the aged 18 and older U.S. population. Phone status targets are based on the July-December 2011 National Health Interview Survey. Population density targets are based on the 2010 census. All reported margins of sampling error include the computed design effects for weighting.

In addition to sampling error, question wording and practical difficulties in conducting surveys can introduce error or bias into the findings of public opinion polls.

For more details on Gallup's polling methodology, visit www.gallup.com.