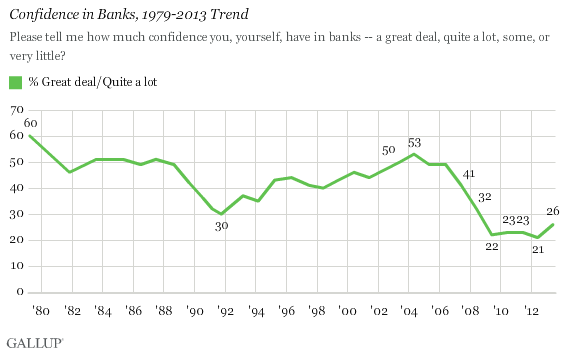

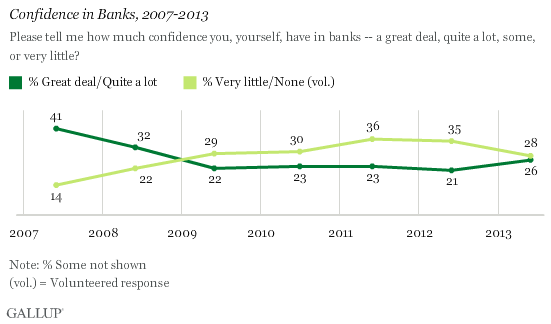

PRINCETON, NJ -- Americans' confidence in U.S. banks increased to 26% in June, up from the record low of 21% a year ago. The percentage of Americans saying they have "a great deal" or "quite a lot" of confidence in U.S. banks is now at its highest point since June 2008, but remains well below its pre-recession level of 41%, measured in June 2007. Between 2007 and 2012, confidence in banks fell by half -- 20 percentage points.

Gallup has asked Americans to say how much confidence they have in a variety of U.S. institutions, including banks, annually since 1993, and periodically prior to that. In the June 1-4 survey, banks ranked 10th among 16 institutions. But Americans' confidence in banks increased the most this year of any institution.

When Gallup first measured confidence in banks in 1979, 60% of Americans had a great deal or quite a lot of confidence in them -- second only to the church. This high level of confidence, which hasn't been matched since, was likely the result of the strong U.S. banking system established after the 1930s Great Depression and the related efforts of banks and regulators to build Americans' confidence in that system.

Confidence in the banking system suffered in the early 1980s, as the U.S. experienced its worst recession since the Great Depression -- at least to that point. Still, confidence in banks remained near the 50% mark in the early '80s, and banks generally ranked in the top half of institutions tested.

Confidence in U.S. banks took another blow with the Savings and Loan crisis of the late 1980s and early 1990s. Confidence fell to a new low of 30% in October 1991. Banking confidence recovered during the latter half of the 1990s and reached 53% in May 2004 -- its highest point since the 60% found in 1979. Americans' confidence in banking remained high through 2006 as borrowing was easy, lending boomed, and the financial bubble of the last part of the decade grew.

Now, as Many Americans Have Confidence in Banks as Do Not

The percentage of Americans saying they have a great deal or quite a lot (26%) of confidence in banks is now about the same as those expressing little or no confidence (28%), moving closer to a net-positive confidence, in contrast to the trend seen over the previous four years. It is noteworthy that not only has the percentage of those who have confidence in banks increased, but also the percentage of those expressing a lack of confidence has declined. Prior to the recession and financial crisis, more Americans consistently said they had a great deal or quite a lot of confidence in U.S. banks than had little or no confidence.

Implications

Americans' confidence in banks may finally be starting to recover from the recession and financial crisis of 2008-2009. Americans' perceptions of their banking system generally take a long time to change -- as is illustrated by the slow recovery in bank confidence ratings after the Savings and Loan crisis of the late '80s and early '90s. Behavioral economics suggests a recovery in perceptions from the biggest financial recession since the Great Depression is likely to take an even longer time.

It is not clear exactly what is driving Americans' improved confidence in banks, but most authorities agree that U.S. banks did well on their "stress tests" and that banks' balance sheets are much improved, as are their earnings.

Further, the fundamental financial health of any banking system depends to a large extent on the condition of the economies where banks do business. While the U.S. economy continues to struggle, it seems to be performing better than most other economies around the world.

Given this context, Americans' improving perceptions of their banking institutions appear to be realistic. In turn, this provides an opportunity for banks, their regulators, and their stakeholders to build on and create momentum for increasing Americans' confidence in the U.S. banking system.

A strong banking system, including strong public confidence, is essential if the U.S. economy is going to achieve strong, sustainable economic growth.

Survey Methods

Results for this Gallup poll are based on telephone interviews conducted June 1-4, 2013, with a random sample of 1,529 adults, aged 18 and older, living in all 50 U.S. states and the District of Columbia.

For results based on the total sample of national adults, one can say with 95% confidence that the maximum margin of sampling error is ±3 percentage points.

Interviews are conducted with respondents on landline telephones and cellular phones, with interviews conducted in Spanish for respondents who are primarily Spanish-speaking. Each sample of national adults includes a minimum quota of 50% cellphone respondents and 50% landline respondents, with additional minimum quotas by region. Landline telephone numbers are chosen at random among listed telephone numbers. Cellphone numbers are selected using random digit dial methods. Landline respondents are chosen at random within each household on the basis of which member had the most recent birthday.

Samples are weighted to correct for unequal selection probability, nonresponse, and double coverage of landline and cell users in the two sampling frames. They are also weighted to match the national demographics of gender, age, race, Hispanic ethnicity, education, region, population density, and phone status (cellphone only/landline only/both, cellphone mostly, and having an unlisted landline number). Demographic weighting targets are based on the March 2012 Current Population Survey figures for the aged 18 and older U.S. population. Phone status targets are based on the July-December 2011 National Health Interview Survey. Population density targets are based on the 2010 census. All reported margins of sampling error include the computed design effects for weighting.

In addition to sampling error, question wording and practical difficulties in conducting surveys can introduce error or bias into the findings of public opinion polls.

For more details on Gallup's polling methodology, visit www.gallup.com.