Story Highlights

- 27% say information hacked from cards used in stores

- Thefts come despite increased use of chip-enabled cards

- Thefts affect affluent much more than low-income households

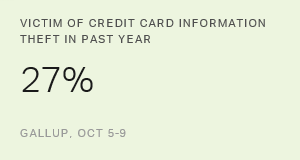

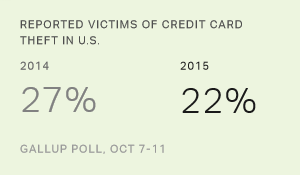

WASHINGTON, D.C. -- Americans are more likely than they were a year ago to say their households were the victims of credit card information theft, despite recent efforts to make the use of credit cards in stores safer. More than one in four (27%) now say they or someone in their household had information stolen from a credit card used in a store, up from a dip to 22% in 2015.

| 2014 | 2015 | 2016 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| % | % | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Credit card information used at a store stolen | 27 | 22 | 27 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Money, property stolen | 15 | 15 | 17 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Identity theft | N/A | 16 | 17 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Home, car, property vandalized | 14 | 15 | 14 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| N/A = Not asked | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gallup Crime Survey, Oct 5-9, list of nine crimes | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Americans are significantly more likely to say their households have been victimized by credit card information theft than to say they were victims of any of the other eight crimes Gallup measured in its 2016 Crime survey. Theft of credit card information has topped the list all three years since Gallup first included it in 2014.

The increase in reports of credit card information theft come at a time when both Visa and MasterCard are aggressively replacing magnetic-stripe credit cards as a way to protect information from hackers. The replacement cards use a chip that generates a unique code for every transaction. Both credit card companies have more than doubled the number of chip-enabled cards in the last year, with MasterCard reporting in July that 88% of their consumer credit cards have the chip.

Things are not moving as swiftly among U.S. businesses. About a third of U.S. stores were able to process chip transactions in August, according to Visa. The National Retail Federation, which has complained the cards are "cumbersome" and do not provide enough security, contends that card companies' slowness in signing off on chip-reading terminals has been a major factor in the delays.

Credit Card Information Victims Vary Greatly by Income, Age

Theft of credit card information is the crime most Americans have in common, but it is much more of a problem for high earners and those aged 35 to 54. At least part of the reason for the discrepancy between high and low earners is that those in higher income brackets are much more likely to have credit cards. In a 2014 Gallup poll, 88% of those with annual household incomes of $75,000 or more said they had at least one card, compared with 41% of those with incomes of less than $30,000. Nearly three in four of those in the $30,000-$74,999 income bracket said they had a card. Among age groups, about half of those under 35 had a credit card, and about three-fourths of those 35 and older had one.

| Yes | No | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| % | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Age | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 18-34 | 19 | 80 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 35-54 | 39 | 61 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 55 and older | 23 | 77 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Household income | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Less than $30,000 | 14 | 86 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| $30,000-$74,999 | 25 | 75 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| $75,000 and above | 41 | 58 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gallup Crime Survey, Oct 5-9 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Americans in higher-earning households, though most likely to report credit card information theft and most likely to have cards, are slightly less likely to worry frequently about it happening to them (40%) than are middle-income Americans (46%). Lower-income Americans are least likely (30%) to say it worries them frequently.

Overall, 38% of Americans say they worry frequently about having their credit card information stolen, the highest percentage for any of the 14 crimes Gallup asked about. The only other crimes which at least a third of Americans say they worry about frequently involve computer hacking:

-

35% worry frequently about having their email, passwords or electronic records hacked into.

-

33% worry frequently about being a victim of identity theft.

-

18% worry frequently about having their car broken into or stolen -- the crime most often mentioned by respondents that did not involve computer hacking.

Bottom Line

Concerns about hacking have produced a worldwide transition to machines that accept chip-enabled cards. The pressure on businesses in the U.S. ratcheted up last year on Oct. 1 when merchants without chip-reading terminals became liable for fraudulent transactions from counterfeit cards.

At this point the changes taking place in the U.S. have neither allayed the fears of consumers that their credit card information will be stolen nor reduced the percentage of Americans saying their households have been victimized.

As differences between merchants and credit card companies are resolved, a broader rollout of chip-reading terminals in U.S. businesses could bring a drop in credit card information theft and a subsequent lessening of worries about the crime.

Survey Methods

Results for this Gallup poll are based on telephone interviews conducted Oct. 5-9, 2016, with a random sample of 1,017 adults, aged 18 and older, living in all 50 U.S. states and the District of Columbia. For results based on the total sample of national adults, the margin of sampling error is ±4 percentage points at the 95% confidence level. All reported margins of sampling error include computed design effects for weighting.

Each sample of national adults includes a minimum quota of 60% cellphone respondents and 40% landline respondents, with additional minimum quotas by time zone within region. Landline and cellular telephone numbers are selected using random-digit-dial methods.

Learn more about how the Gallup Poll Social Series works.