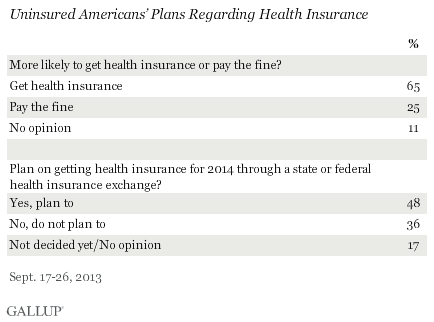

PRINCETON, NJ -- Nearly two in three uninsured Americans say they will get insurance by Jan. 1, 2014, rather than pay a fine as mandated by the Affordable Care Act (ACA), while one in four say they will pay the fine. Less than half of the uninsured say they plan on getting health insurance specifically through a federal or state health insurance exchange.

Gallup asked a nationally representative sample of 5,099 Americans between Sept. 17-26 about their awareness of several pending ACA provisions and their anticipated healthcare choices in the months ahead. The ACA requires that most Americans get insurance by Jan. 1, 2014, or pay a fine, and advocates of the ACA are urging the uninsured to take advantage of new federal and state health exchanges to obtain health insurance.

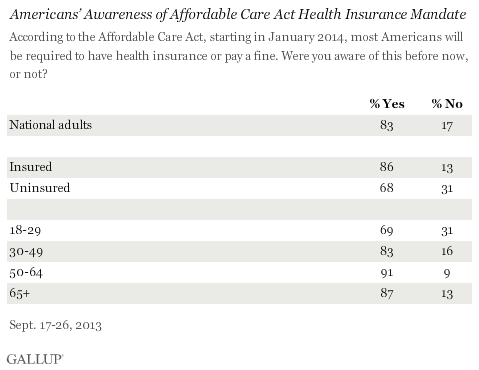

Overall, 83% of Americans are aware that most Americans will be required to have health insurance or pay a fine beginning January 2014. This awareness drops to 68% among those who are uninsured, and is at 69% among the vital group of 18- to 29-year-olds who are the most likely of any age group to be uninsured.

Although the uninsured's awareness of the individual mandate component of the ACA remains below the national average, it is up by 12 percentage points from a June 20-24 survey, when 56% of uninsured Americans said they were aware of it.

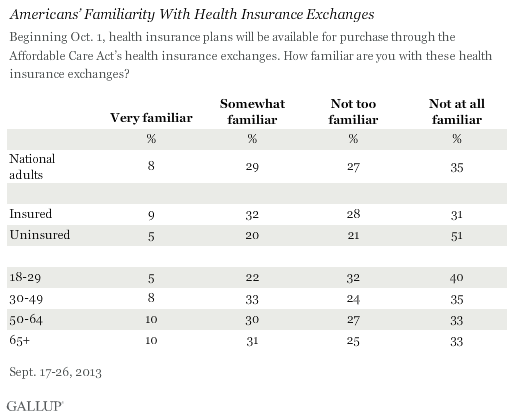

Familiarity With Exchanges Is Low

One of the primary components of the ACA is the creation of government-run health insurance exchanges. These exchanges are essentially websites in each state that provide a central clearinghouse where individuals can review and then purchase health insurance. Consumers can also find out if they qualify, based on their income, for government subsidies of their health insurance premiums. These exchanges are a major part of the ACA and have been heavily featured in ACA promotion.

At this juncture, relatively few Americans -- 37% -- are familiar with the health exchanges, even though these insurance marketplaces officially open for business on Oct. 1. Familiarity with the exchanges is even lower among the crucial group of Americans who do not have health insurance. In fact, half of the uninsured say they are "not at all familiar" with the exchanges.

And young adults aged 18 to 29 are also less familiar with the exchanges than those who are older.

This low level of familiarity with the exchanges may help explain the finding that less than half of the uninsured say they will get health insurance for 2014 specifically through a state or federal health insurance exchange.

Overall, 66% of the uninsured who plan on getting health insurance rather than pay a fine say they will get insurance through an exchange, leaving the rest who apparently are unsure about how they will get their insurance, or who will seek insurance perhaps through their employer, through Medicare or Medicaid, or buy a plan on their own outside of an exchange.

Implications

Although less than half of the uninsured say they plan on buying health insurance for 2014 through a federal or state exchange, this percentage may well rise in the months ahead for two reasons. First, almost-two thirds of the uninsured say they are more likely to get health insurance rather than pay a fine if they don't, indicating a demand for insurance that will need to be fulfilled in some fashion over the next three months. Second, current familiarity with the health exchanges among the uninsured is low, and as awareness increases, willingness to use the exchanges may rise as well.

Survey Methods

Results for this Gallup poll are based on telephone interviews conducted Sept. 17-26, 2013, on the Gallup Daily tracking survey, with a random sample of 5,099 adults, aged 18 and older, living in all 50 U.S. states and the District of Columbia.

For results based on the total sample of national adults, one can say with 95% confidence that the margin of sampling error is ±2 percentage points.

For results based on the total sample of 4,427 adults with health insurance, one can say with 95% confidence that the margin of sampling error is ±2 percentage points.]

For results based on the total sample of 651 adults without health insurance, one can say with 95% confidence that the margin of sampling error is ±5 percentage points.]

Interviews are conducted with respondents on landline telephones and cellular phones, with interviews conducted in Spanish for respondents who are primarily Spanish-speaking. Each sample of national adults includes a minimum quota of 50% cellphone respondents and 50% landline respondents, with additional minimum quotas by time zone within region. Landline and cellular telephone numbers are selected using random-digit-dial methods. Landline respondents are chosen at random within each household on the basis of which member had the most recent birthday.

Samples are weighted to correct for unequal selection probability, nonresponse, and double coverage of landline and cell users in the two sampling frames. They are also weighted to match the national demographics of gender, age, race, Hispanic ethnicity, education, region, population density, and phone status (cellphone only/landline only/both, cellphone mostly, and having an unlisted landline number). Demographic weighting targets are based on the March 2012 Current Population Survey figures for the aged 18 and older U.S. population. Phone status targets are based on the July-December 2011 National Health Interview Survey. Population density targets are based on the 2010 census. All reported margins of sampling error include the computed design effects for weighting.

In addition to sampling error, question wording and practical difficulties in conducting surveys can introduce error or bias into the findings of public opinion polls.

For more details on Gallup's polling methodology, visit www.gallup.com.