Story Highlights

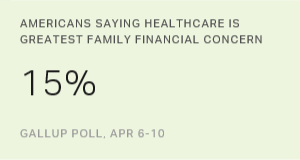

- 15% of Americans say healthcare costs are family's top financial concern

- Those without money to live comfortably concerned with immediate living costs

- About one in 10 Americans say their family faces no financial problems

WASHINGTON, D.C. -- Fifteen percent of Americans cite healthcare costs as the most important financial problem facing their family. In addition to healthcare costs, Americans also point to low wages, debt, college expenses and housing costs as pressing financial concerns for their family. About one in 10 Americans say their family faces no financial problems.

| U.S. adults% | Have enough money to live comfortably % | Do not have enough money to live comfortably% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Healthcare costs | 15 | 15 | 11 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Lack of money/Low wages | 13 | 6 | 17 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Not enough money to pay debts | 9 | 7 | 11 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| College expenses | 9 | 9 | 6 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Costs of owning/renting a home | 8 | 6 | 10 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| High cost of living/Inflation | 7 | 8 | 5 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Unemployment/Loss of job | 6 | 5 | 8 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Taxes | 5 | 6 | 3 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Retirement savings | 5 | 7 | 1 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Lack of savings | 3 | 3 | 2 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Social Security | 2 | 2 | 2 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| State of the economy | 1 | 1 | 2 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Controlling spending | 1 | 1 | 1 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Energy costs/Oil and gas prices | 1 | 1 | 1 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest rates | 1 | 1 | 0 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Stock market/Investments | 1 | 1 | 0 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| None | 11 | 13 | 4 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other | 4 | 4 | 3 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| April 6-10, 2016 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gallup Poll | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

These results are from Gallup's annual Economy and Personal Finance poll, conducted April 6-10 this year.

While healthcare costs top the list of family financial concerns among Americans overall, the problems that Americans cite as most important differ between those with and without enough money to live comfortably. Thirteen percent of those with enough money to live comfortably say they have no important financial problems, compared with 4% among those who do not have enough to live comfortably.

Long-Term Saving Concerns Top List for Those Living Comfortably

Americans who say they have enough money to live comfortably are more likely to cite long-term saving concerns such as retirement savings and college expenses as their most pressing financial problem. Meanwhile, those without enough money to live comfortably express greater concern about more immediate financial problems, including low wages, debt payments and housing costs.

Among those living comfortably on their current income, for example, 7% mention retirement savings and 9% cite college expenses as their family's most pressing financial problem. These Americans tend to be older, more educated and wealthier: 74% of those aged 65 and older, 80% of college graduates and 88% of those living in households earning $75,000 or more per year report having enough money to live comfortably.

| Have enough money to live comfortably % | Do not have enough money to live comfortably% | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Income | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Less than $30,000 | 36 | 64 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| $30,000 to less than $75,000 | 67 | 33 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| $75,000 or more | 88 | 12 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Education | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Graduated college | 80 | 19 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Did not graduate college | 61 | 39 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Age | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 18 to 29 | 65 | 34 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 30 to 49 | 63 | 37 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 50 to 64 | 65 | 35 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 65+ | 74 | 25 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| April 6-10, 2016 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gallup Poll | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Alternatively, those not living comfortably on their current income are more likely to point to immediate financial concerns about low wages (17%), debt payments (11%) and housing costs (10%). Compared with those who have the financial means to live comfortably, these Americans have less income and less education. Sixty-four percent of Americans earning less than $30,000 in annual household income and 39% of those without a college degree say they do not have enough money to live comfortably.

Bottom Line

These financial problems facing U.S. families parallel Americans' unease about the economy more broadly. In the past three months, Americans have consistently cited the economy as the most important issue facing the country. However, the contrasting nature of these concerns points to a much different reality for those without the financial means to live comfortably. Americans living in financial comfort emphasize concerns about meeting long-term financial goals, while those without enough money to live comfortably must instead sacrifice future financial goals to meet the immediate costs of living.

Historical data are available in Gallup Analytics.

Survey Methods

Results for this Gallup poll are based on telephone interviews conducted April 6-10, 2016, on the Gallup U.S. Daily survey, with a random sample of 1,015 adults, aged 18 and older, living in all 50 U.S. states and the District of Columbia. For results based on the total sample of national adults, the margin of sampling error is ±4 percentage points at the 95% confidence level. All reported margins of sampling error include computed design effects for weighting.

Each sample of national adults includes a minimum quota of 60% cellphone respondents and 40% landline respondents, with additional minimum quotas by time zone within region. Landline and cellular telephone numbers are selected using random-digit-dial methods.

View complete question responses and trends.

Learn more about how the Gallup U.S. Daily works.