Story Highlights

- Younger nonretirees leaning more toward savings accounts for retirement

- Those aged 40 to 59 counting less on pensions, home equity

- Social Security, pensions still top money sources for retirees

WASHINGTON, D.C. -- Economic turmoil over the past eight years has reshaped the views of both older and younger American nonretirees on how they will pay for retirement -- but in decidedly different ways. Those younger than 40 are more likely now than before 2008 to view savings and part-time work as major sources of retirement income, while nonretirees in their 40s and 50s are now less likely to say they will rely heavily on pensions and home equity.

| 2002-2007% | 2013-2016% | Change(pct. pts.) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Aged 18 to 39 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 401(k), IRA, other retirement savings accounts | 57 | 51 | -6 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Savings accounts, CDs | 26 | 37 | 11 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Pension plans | 26 | 22 | -4 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Stocks, mutual funds | 24 | 19 | -5 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Home equity | 23 | 19 | -4 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Social Security | 18 | 23 | 5 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Part-time work | 17 | 24 | 7 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Aged 40 to 59 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 401(k), IRA, other retirement savings accounts | 48 | 46 | -2 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Savings accounts, CDs | 12 | 15 | 3 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Pension plans | 34 | 26 | -8 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Stocks, mutual funds | 19 | 19 | 0 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Home equity | 29 | 22 | -7 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Social Security | 33 | 34 | 1 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Part-time work | 15 | 19 | 4 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Combined results from Gallup surveys in 2002-2007 and 2013-2016 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

In the years leading up to the recession, a majority of U.S. nonretirees the furthest from retirement -- those aged 18 to 39 -- expected individual retirement accounts, or IRAs, and other 401(k)-type retirement savings accounts to be a major source of retirement funds. An average 57% in Gallup's annual Economy and Personal Finance polls from 2002 through 2007 predicted these accounts would be a primary foundation for them. At the same time, 26% said they expected savings accounts to be a major source of retirement money, 26% named pension plans, 24% mentioned stocks or mutual funds, and 23% listed home equity.

Then came a series of economic shocks, led by the bursting of the housing bubble in 2006 and 2007. Over the next few years, home values dropped by almost 30%, the Dow Jones industrial average lost more than 40% of its value, and the national unemployment rate doubled.

Since 2013, home values and stock prices have mostly recovered, and unemployment is back down to the 5% range. But many younger nonretirees who witnessed the turmoil may have decided that a savings account is the safest way to protect their earnings for retirement. In four Gallup polls from April 2013 through April 2016, an average 37% of those aged 18 to 39 list savings accounts as a major source of retirement money, up 11 percentage points from the 26% who named it in the 2002-2007 polls. Retirement savings accounts such as IRAs and 401(k)s are still the source mentioned most often, but the percentage naming retirement accounts has dropped from 57% to 51%. Savings accounts are now a clear second among this group, and between 19% and 24% of nonretirees mention the five remaining sources tested.

For those closer to retirement, who may have a better sense of what their options for major sources of retirement income will be, there has been less change overall, and the biggest changes have been decreases. Thirty-four percent of nonretirees in their 40s and 50s polled prior to 2008 expected pensions to be a major source of retirement income, but that has dropped to 26% in the polls after 2012. Home equity was listed as an expected source of retirement income by 29% of nonretirees in 2002-2007 -- the period when the housing bubble pushed average home values up by more than 30%. But despite recent improvements in the housing market, only 22% in polling since 2012 have said they expect home equity to be a major money source during retirement.

Self-directed retirement savings plans such as 401(k)s and IRAs remain the top expected source for those between the ages of 40 and 59. Social Security has overtaken pension plans as the second most common expected source for this age group. Overall, despite negative media coverage of the long-term viability of Social Security, both age groups of nonretirees have maintained or increased their expectations for relying on it.

Social Security, Pensions Most Common Sources of Retirement Income

A separate measure on the April poll asks retirees how much they currently rely on most of the same sources of income. (Part-time workers are not included in Gallup's definition of retirees.) Combined Gallup polling on this measure from the last four years shows Social Security to be, by far, the most common source of retirement income for today's retirees, with an average 59% calling it a major source. Though many U.S. companies have phased out pensions in favor of 401(k) accounts, 37% of retirees currently name pensions as a major income source, while 23% say the same for retirement savings accounts such as 401(k)s and IRAs.

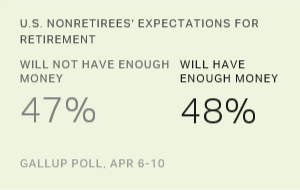

As in the past, there are significant differences between retirees' reliance on various income sources and nonretirees' expected reliance on the same sources. For example, 31% of nonretirees expect Social Security to be a major source of income when they retire, but 59% of current retirees say it is a major source for them. And while 23% of current retirees list retirement savings accounts as a major source, 47% of nonretirees expect them to be. Smaller gaps between retirees' experience and nonretirees' expectations are apparent concerning pensions, home equity, savings accounts and individual stock investments.

| Will be a major source of retirement income (Nonretirees)% | Is a major source of income (Retirees)% | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 401(k), IRA, other retirement savings accounts | 47 | 23 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Social Security | 31 | 59 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Savings accounts, CDs | 24 | 11 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Pension plans | 24 | 37 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Home equity | 20 | 18 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Stocks, mutual funds | 19 | 13 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Combined results from Gallup surveys in 2002-2007 and 2013-2016 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Reinforcing Americans' attachment to 401(k)-type savings plans to fund their retirement, the latest Wells Fargo/Gallup Investor and Retirement Optimism Index survey found that the vast majority of employed U.S. investors who participate in a 401(k) savings plan view it positively. More than four in 10 (44%) are "very" satisfied with their plan, and 47% are "somewhat" satisfied.

Bottom Line

The economic twists and turns of the past decade did not fundamentally change Americans' plans for how they will fund their days as retirees, but it did create some shifts in emphasis on different approaches. Older nonretirees are less likely than before the recession to think they can count on their home's equity or on pensions. Their younger counterparts -- who have been less affected than older generations by inflation worries -- are now more likely to want to salt their money away in a savings account. They also are more likely to think that part-time work might be a major element of their retirement security.

These changing expectations have not yet come into play in any major way. Younger retirees -- those aged 61 to 70 in the 2013-2016 polls -- do not differ greatly from older retirees when it comes to major sources of income. And Social Security, despite the dire warnings, still provides a major source of income for more than half of retired Americans. Nonretirees are no less likely to say they will rely on it than they were prior to the recession.

Survey Methods

Results for this Gallup poll are based on the combined results of two sets of Gallup Economy and Personal Finance surveys. Aggregated results from six surveys conducted in 2002, 2003, 2004, 2005, 2006 and 2007 are based on telephone interviews with a random sample of 1,764 retirees and 5,319 nonretirees. Aggregated results from four surveys conducted in 2013, 2014, 2015 and 2016 are based on telephone interviews with a random sample of 1,669 retirees and 3,404 nonretirees. All respondents were aged 18 and older, living in all 50 U.S. states and the District of Columbia. For results based on retirees, the margin of sampling error is ±3 percentage points at the 95% confidence level. For results based on nonretirees, the margin of sampling error is ±2 percentage points.

Each sample of national adults includes a minimum quota of 60% cellphone respondents and 40% landline respondents, with additional minimum quotas by time zone within region. Landline and cellular telephone numbers are selected using random-digit-dial methods.

Learn more about how the Gallup Poll Social Series works.