Story Highlights

- Highest Gallup Good Jobs rate in any April since 2010

- Unemployment down to 5.2%, lowest in any month since 2010

- Workforce participation up 0.4 points to 67.3%

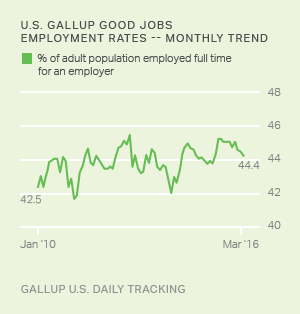

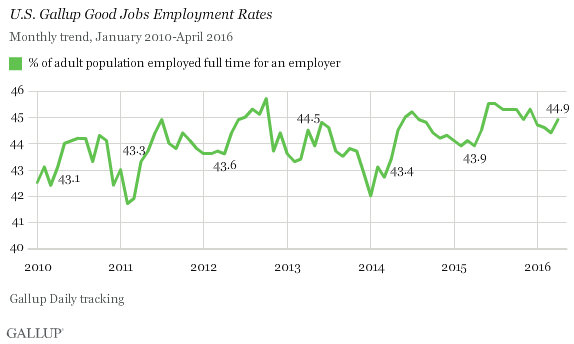

WASHINGTON, D.C. -- The Gallup Good Jobs (GGJ) rate in the U.S. was 44.9% in April. This is up nominally from the March rate (44.4%) and, although lower than a number of months last summer and fall, it is higher than the rate in any April since Gallup began measuring it in 2010. The current rate is a full percentage point higher than in April 2015, suggesting an underlying increase in full-time work beyond seasonal changes in employment.

The GGJ metric tracks the percentage of U.S. adults, aged 18 and older, who work for an employer full time -- at least 30 hours per week. Gallup does not count adults who are self-employed, work fewer than 30 hours per week, are unemployed or are out of the workforce as payroll-employed in the GGJ metric.

The latest results are based on Gallup Daily tracking interviews with 30,439 U.S. adults, conducted April 1-30 by landline telephone and cellphone. GGJ is not seasonally adjusted.

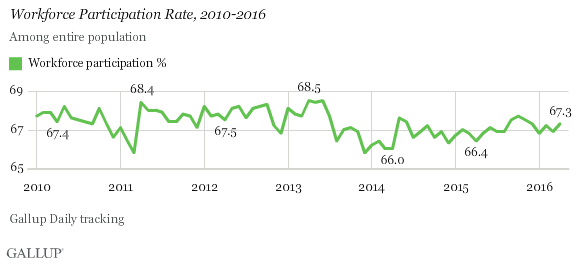

Workforce Participation at 67.3% in April

The percentage of U.S. adults in April who participated in the workforce -- by working full time, part time or not working but actively seeking and being available for work -- was 67.3%. This is up slightly from the March rate (66.9%) and just above the 66.9% average workforce participation rate since July 2013. Current workforce participation is slightly lower than the period from March 2010 to June 2013, when it averaged 67.7%.

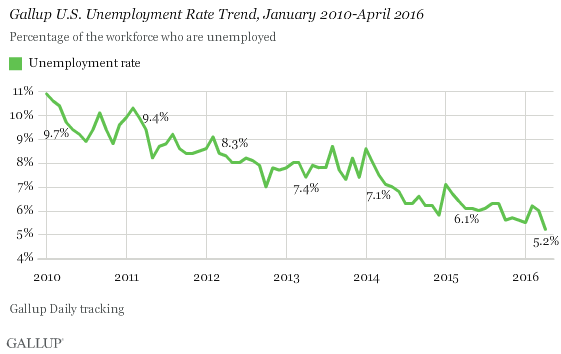

Unemployment at 5.2%

Gallup's unadjusted U.S. unemployment rate was 5.2% in April, down from March's 6.0%. April's unemployment estimate is the lowest for any month since Gallup began tracking the measure in 2010, and marks a general and continuing decline in unemployment over that period. Gallup's U.S. unemployment rate represents the percentage of adults in the workforce who did not have any paid work in the past seven days, either for an employer or for themselves, and who were actively looking for and available to work.

Unlike Gallup's GGJ rate, which is a percentage of the total population, the unemployment rates that Gallup and the U.S. Bureau of Labor Statistics (BLS) report are percentages of the labor force. While both Gallup and BLS data are based on surveys with large sample sizes, the two have important methodological differences -- outlined at the end of this article. Additionally, the most-discussed unemployment rate released by the BLS each month is seasonally adjusted, while Gallup reports unadjusted numbers. Although Gallup's unemployment numbers strongly correlate with BLS rates, the BLS and Gallup estimates of unemployment do not always track precisely on a monthly basis.

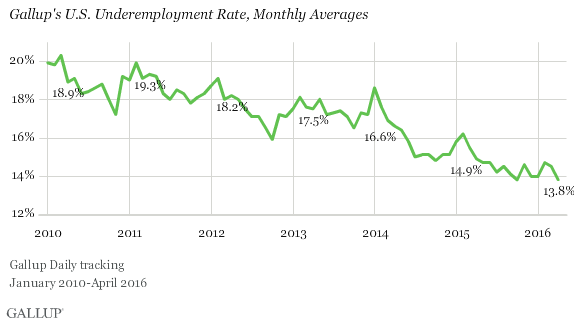

Underemployment Also Down, Now 13.8%

Gallup's measure of underemployment in April was 13.8%, also down slightly from March (14.4%) and tied with October 2015's measure for the lowest Gallup has recorded since 2010. Gallup's U.S. underemployment rate combines the percentage of adults in the workforce who are unemployed (5.2%) with those who are working part time but desire full-time work (8.6%). Underemployment rates were much higher from 2010 through June 2014 than they have been since.

Bottom Line

Increasing full-time employment and decreasing unemployment have typically occurred in April over the past six years, and in that sense, this past month's findings are in line with previously observed seasonal patterns. However, April 2016 stands out as having the highest GGJ rate of any April dating back to 2010, as well as the lowest unemployment that Gallup has yet recorded. This indicates that a broader, continuing improvement is occurring in the U.S. labor market beneath the seasonal pattern.

The BLS continued to report declining seasonally adjusted weekly rates of unemployment insurance claims through the end of last month, another sign that the employment situation is continuing to improve in 2016. Yet Americans' economic confidence has waned in recent months, and Gallup's job creation measure, though strong, has remained essentially flat over that same period. It remains to be seen whether these trends are foreshadowing a weakening in the job market, or whether a stronger job market may begin to improve the public's economic perceptions.

The data in this article are available in Gallup Analytics.

| Most recent month (April 2016)% | Previous month (March 2016)% | Month a year ago (April 2015)% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Employed full time for employer (GGJ)* | 44.9 | 44.4 | 43.9 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Employed full time self* | 5.9 | 5.6 | 5.6 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Workforce participation rate* | 67.3 | 66.9 | 66.4 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Unemployment rate ** | 5.2 | 6.0 | 6.1 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Employed part time wanting full time** | 8.6 | 8.5 | 8.9 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Underemployment rate** | 13.8 | 14.4 | 14.9 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| *Metrics represent percentages of U.S. population aged 18 or older who have a job or are actively seeking work **Metrics represent percentages of U.S. workforce | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gallup U.S. Daily Tracking | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| GALLUP | U.S. Bureau of Labor Statistics | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 18 and older | 16 and older | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Not seasonally adjusted | Seasonally adjusted | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 30,000 individuals per month | 60,000 households per month | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| RDD telephone, including cellphones | Rotating panel with face-to-face and telephone interviewing | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Continuous | One-week reference period during mid-month | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Daily, weekly, and monthly, based on 30-day rolling averages | Monthly, based on one-week reference period | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gallup | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Gallup.com reports results from these indexes in daily, weekly and monthly averages and in Gallup.com stories. Complete trend data are always available to view in the following charts:

Daily: Employment, Economic Confidence and Job Creation, Consumer Spending

Weekly: Employment, Economic Confidence, Job Creation, Consumer Spending

Read more about Gallup's economic measures.

View our economic release schedule.

Survey Methods

Results for this Gallup poll are based on telephone interviews conducted April 1-30, 2016, on the Gallup U.S. Daily survey, with a random sample of 30,439 adults, aged 18 and older, living in all 50 U.S. states and the District of Columbia. For results based on the total sample of national adults, the margin of sampling error is ±1 percentage point at the 95% confidence level. All reported margins of sampling error include computed design effects for weighting.

Each sample of national adults includes a minimum quota of 60% cellphone respondents and 40% landline respondents, with additional minimum quotas by time zone within region. Landline and cellular telephone numbers are selected using random-digit-dial methods.

Learn more about how the Gallup U.S. Daily works.