Story Highlights

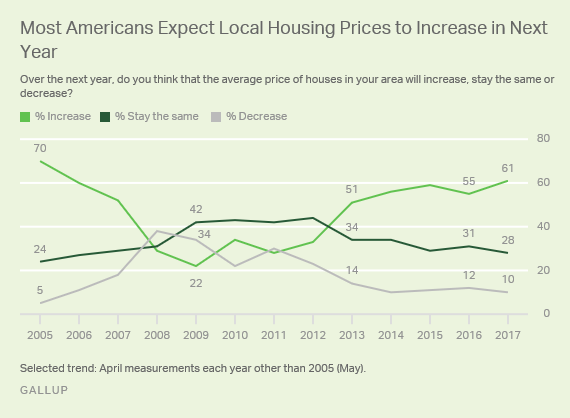

- 61% expect local home values to rise in next year

- Highest since 70% in 2005

- Two-thirds continue to say it is a good time to buy a house

WASHINGTON, D.C. -- Sixty-one percent of U.S. adults predict housing prices in their local area will increase in the next 12 months, up from 55% a year ago and the highest Gallup has measured since 2005.

Americans' optimism about home values continues to recover from where it was after the housing bust and recession. Between 2008 and 2012, only as many as one-third of Americans, including a low of 22% in 2009, believed local housing prices would increase.

By 2013, a majority again held this view for the first time since 2007. This year, the percentage expecting housing-value gains pushed past 60%.

The high point in Gallup's trend was 70% in 2005, the first year it asked the question and shortly before U.S. home values hit their peak.

These expectations largely mirror what has happened to U.S. home values over the past 10 years, with declines between 2007 and 2011, and increases beginning in 2012 and continuing since then.

In addition to the 61% currently expecting local housing prices to rise, 28% predict they will stay the same and 10% say they will decrease.

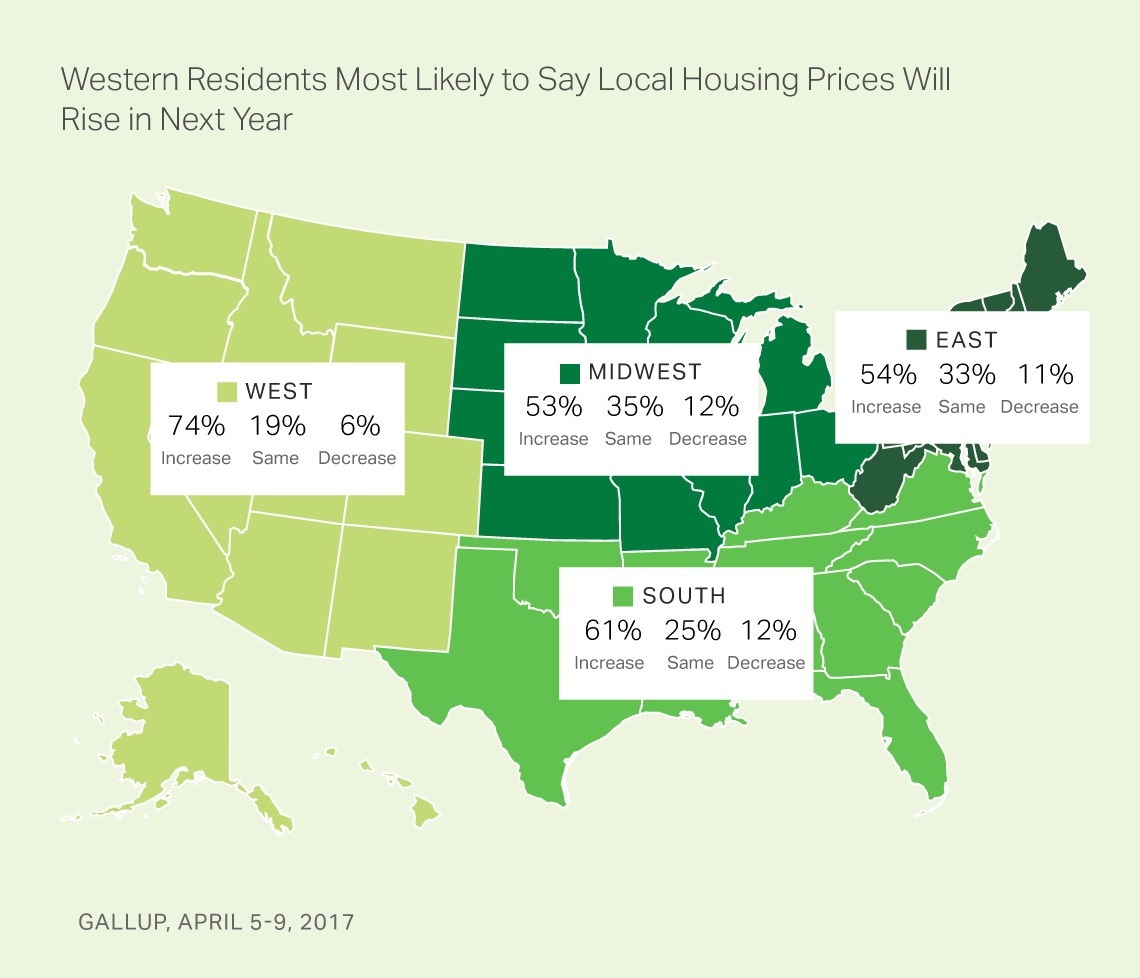

Home-value expectations vary by region, with nearly three-quarters of those in the West predicting increases, compared with slightly more than half of Midwestern and Eastern residents. In 2016, some of the largest increases in home values occurred in the Western U.S.

These regional differences are typical -- in recent years, Western residents have been more likely than those in other parts of the country to say local home values will rise in their area.

Two in Three Say It Is a Good Time to Buy a House

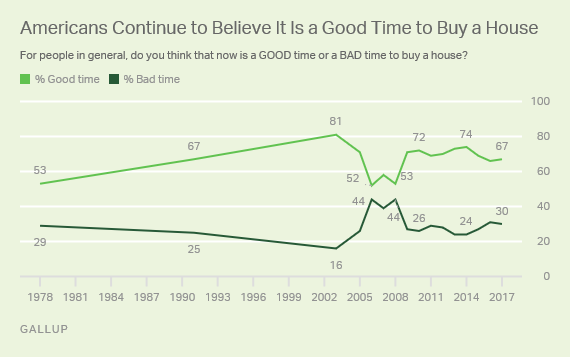

Sixty-seven percent of Americans believe now is a good time to buy a house; 30% say it is a bad time. Those figures are similar to what Gallup measured in the previous two years but are down slightly from 2012-2014, when at least 70% thought it was a good time to buy a house.

A majority of Americans have always said it is a good time to buy a house, though the percentage holding this view fell to the 50% range between 2006 and 2008. These trends suggest that Americans' beliefs on this matter are influenced by the health of the housing market, but also by their philosophical beliefs about the benefits of homeownership. To this end, more Americans choose real estate than other options when asked to name the best investment.

There are no differences in views of buying a home by region. As one might expect, homeowners (74%) are more likely than renters (56%) to say it is a good time to buy a house.

Americans continue to widely endorse homeownership even though fewer now own a home than in the past. From 2004 through 2007 -- before the housing crash -- an average of 72% of U.S. adults reported owning a house. Since 2015, the average is 61%.

Declining homeownership could be a factor in why the percentage saying it is a good time to buy a house has dipped below 70%. Higher home prices may also be affecting Americans' perceptions of whether now is a good time to purchase a home.

Implications

Americans -- both those who own a home and those who do not -- appear to be cognizant of trends in home prices. With U.S. home values showing consistent increases over the past five years after several years of decline, Americans expect local home prices to continue to rise. While Americans' optimism is not yet back to where it was during the housing boom in the mid-2000s, it is now the closest it has been since the housing bubble burst in 2007.

The continued increase in housing prices leads to questions of whether another housing bubble could occur. While prices now are nearly where they were a decade ago, houses are more affordable because of lower interest rates, and banks are more reluctant to issue risky mortgages than they were before the mid-2000s housing market crash. Still, if housing prices continue to rise and interest rates increase, the potential for a new housing bubble will grow.

Historical data are available in Gallup Analytics.

Survey Methods

Results for this Gallup poll are based on telephone interviews conducted April 5-9, 2017, with a random sample of 1,019 adults, aged 18 and older, living in all 50 U.S. states and the District of Columbia. For results based on the total sample of national adults, the margin of sampling error is ±4 percentage points at the 95% confidence level. All reported margins of sampling error include computed design effects for weighting.

Each sample of national adults includes a minimum quota of 70% cellphone respondents and 30% landline respondents, with additional minimum quotas by time zone within region. Landline and cellular telephone numbers are selected using random-digit-dial methods.

View survey methodology, complete question responses and trends.

Learn more about how the Gallup Poll Social Series works.