Thanks for your interest!

You can download our Creating More Digital-Forward Customers recommendations now; we also sent them to your inbox.

How to Improve Digital Adoption in Financial Services

Download our recommendations for driving digital enablement through human channels and optimizing your customers' digital adoption.

Download our recommendations for driving digital enablement through human channels.

Drive Digital Enablement Through Human Channels to Accelerate Digital Adoption in Banking

Just because your bank designs and offers digital tools and features doesn't mean your customers will use them.

Availability doesn't equal adoption, and the lack of adoption costs large institutions more than $5 billion in customer value and cost savings.

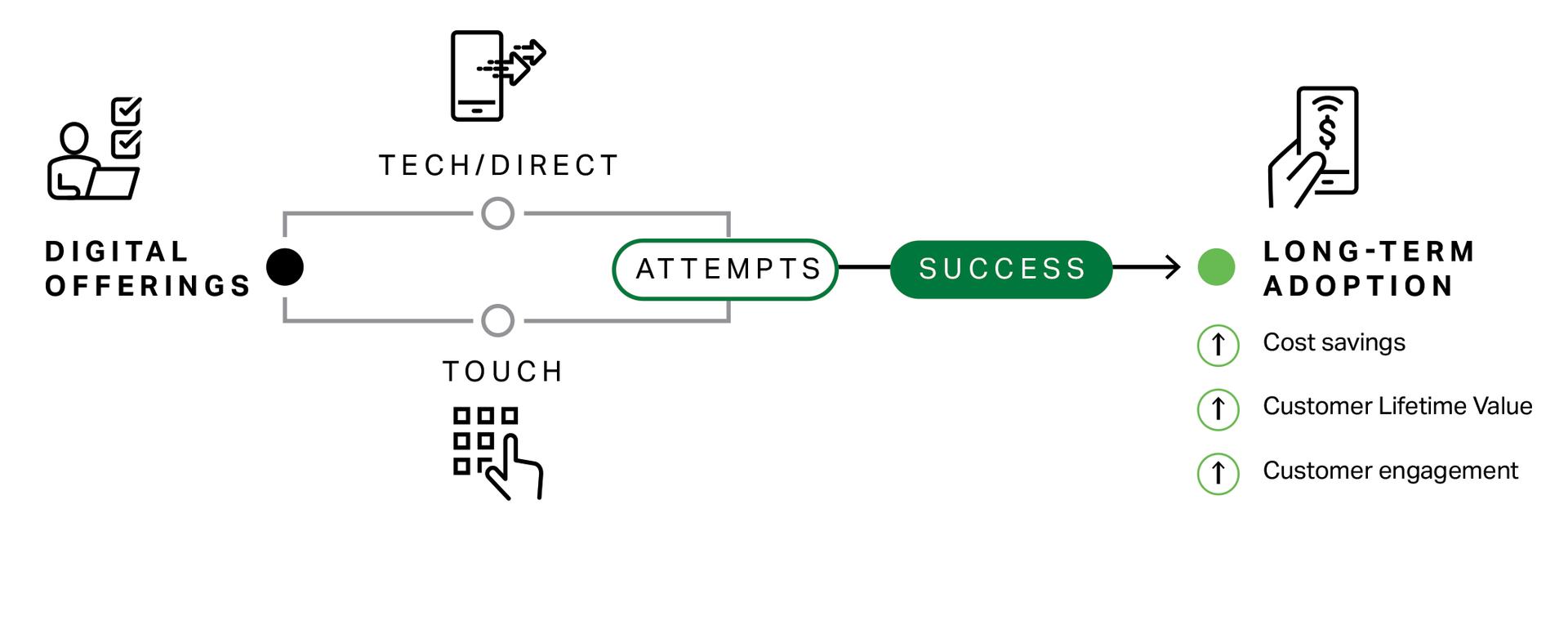

We help our clients create the kind of long-term adoption that lowers the cost to serve, increases customer lifetime value and bolsters your customers' engagement with your institution.

Download our recommendations for improving your customers' digital adoption to learn:

- why the path to creating more digital-forward customers starts with a human-driven strategy

- why you should know your bank's TrueDigital Quotient

- why you must increase your digital-forward customers and decrease your digital laggards

- what the common challenges are to enabling digital adoption through human channels and how to overcome them

Partner With Gallup to Grow Your Business

We help clients across the full spectrum of global financial services accomplish organic growth using a human-centered approach.

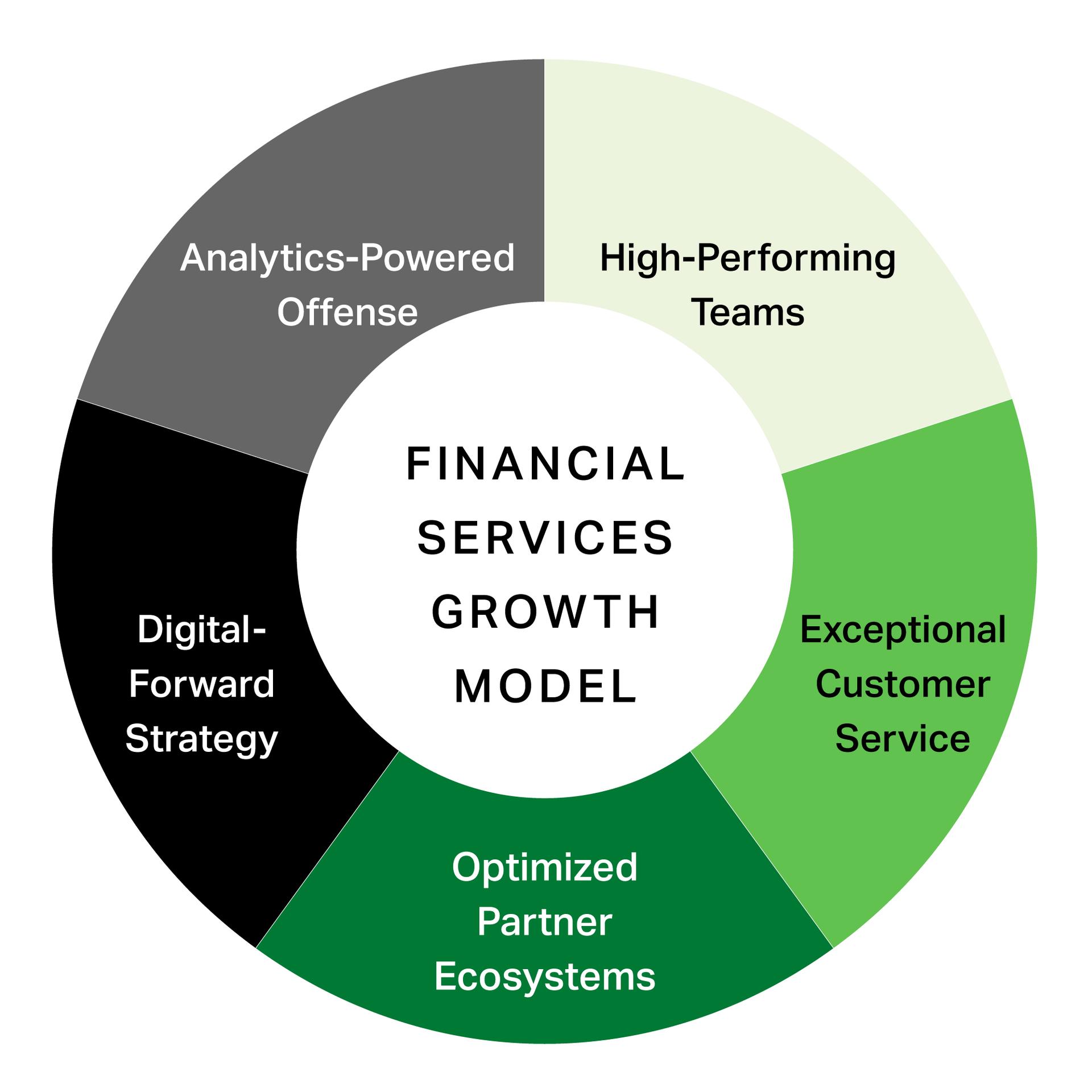

Learn more about our approach to helping companies like yours create the right growth model.

Gallup's Financial Services Growth Model has five components that work together to increase organic growth. The components are high-performing teams, exceptional customer service, optimized partner systems, digital forward strategies, and an analytics powered offense. Gallup analytics can help financial service leaders maximize each aspect of the growth model, individualized to the bank to serve the bank's unique needs