The following is an excerpt from Blind Spot, Gallup's new book about the rising unhappiness leaders didn't see. For more insights like this, order your copy of Blind Spot today.

"I wish for an increase in my wages because with my meager salary I cannot afford to buy decent food for my family. If the food and clothing problems were solved, then I would feel at home and be satisfied. Also if my wife were able to work, the two of us could then feed the family and I am sure would have a happy life and our worries would be over." (30-year-old sweeper in India in 1965, monthly income approximately $13)

So, does money buy happiness?

Here is Gallup's best attempt at answering this question: Money does not buy happiness, but it is hard to be happy without it.

The earliest research on the "Does money buy happiness?" question found that money can buy happiness, but only in a relative sense. This insight is rooted in a theory known as the relative income hypothesis by economist James Duesenberry. It assumes people's consumption habits have more to do with their neighbors' standard of living than their own.

Duesenberry's theory applied to what people bought, not how they felt about life. Economist Richard Easterlin advanced this research by answering this question: Do people also rate their lives based on how their neighbors' lives are going?

In his influential 1974 paper Does Economic Growth Improve the Human Lot? Some Empirical Evidence, Easterlin found that people do rate their lives based on how their neighbors' lives are going. He discovered that rich people rate their lives higher than poor people within the same country. However, when you compare how people rate their lives in rich countries with how people rate their lives in poor countries, you do not see much of a difference. He also found that as countries get richer, people do not get happier.

These findings present a paradox -- known as the Easterlin paradox -- regarding how money affects people's lives. The paradox is that economic growth does not make people happier; people are only happier if they have more money than other people in their own country.

These findings appear to statistically support the idea behind the early 20th-century comic strip Keeping Up With the Joneses. People don't rate their lives on a global scale; they assess how their lives are going based on how their neighbors are doing. Easterlin emphasized this point quoting Karl Marx: "A house may be large or small; as long as the neighboring houses are likewise small, it satisfies all social requirements for a residence. But let there arise next to the little house a palace, and the little house shrinks to a hut."

This finding raised critical questions for policymakers: How important is economic growth? How important is income? If your happiness is contingent on your neighbor's wealth, giving you both an extra $1,000 per month will not improve your life because your neighbor will still have more.

One of the limitations of Easterlin's work is that much of the data came from only a handful of countries. That changed in the 21st century, particularly with the Gallup World Poll. We now conduct wellbeing studies more frequently in far more countries.

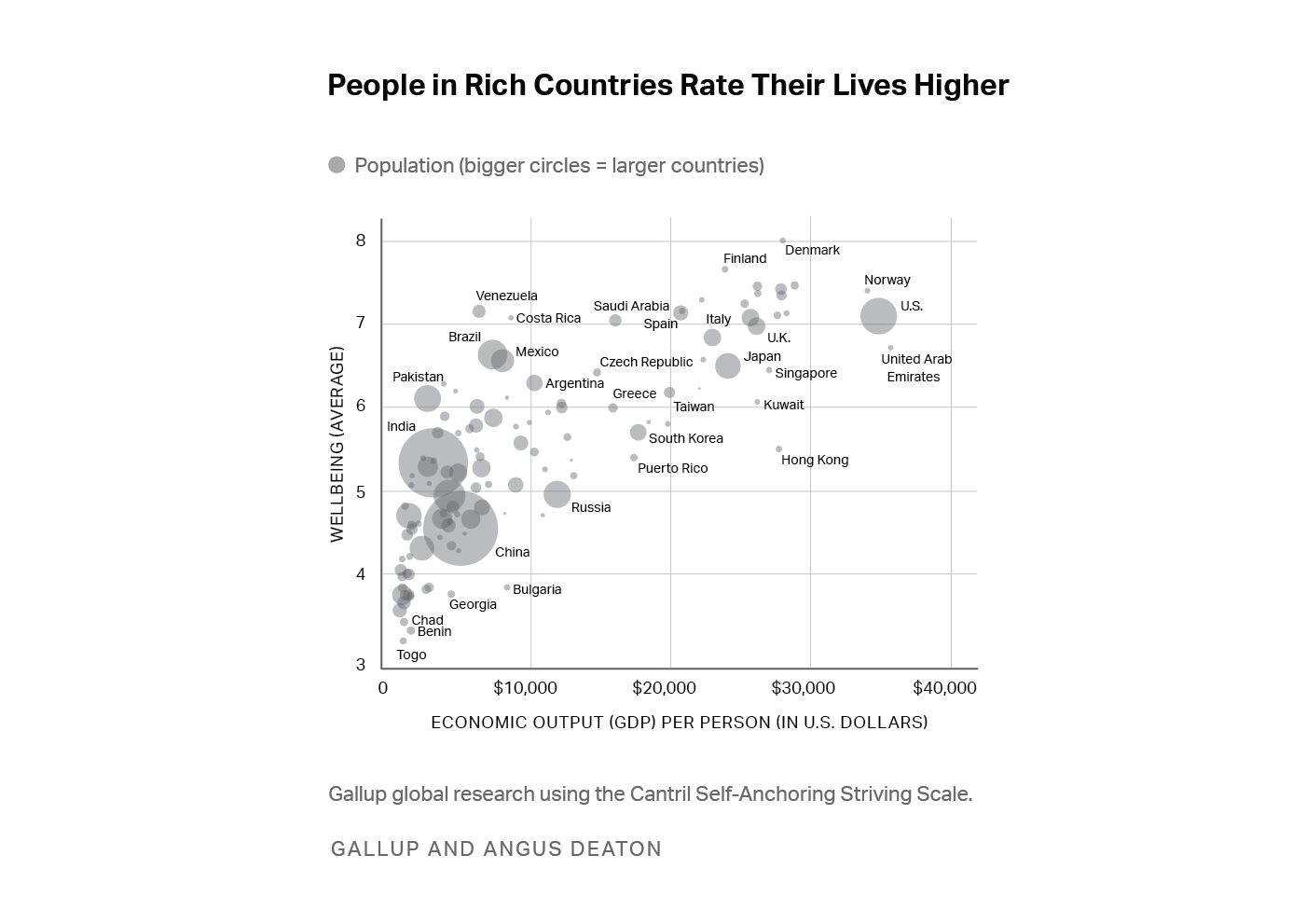

One of the first global datasets from Gallup led to one of the most influential papers in the discourse of income and wealth. This paper, written by Angus Deaton, produced a finding that contradicted part of the Easterlin paradox. Deaton found that people in rich countries do rate their lives better than people in poor countries, which suggests that economic growth does cause people to see their lives better.

His analysis revealed a high positive correlation with life evaluation and GDP per capita. People in rich countries such as Denmark and Norway, on average, rate their lives higher than people in lesser developed places such as Togo and the Palestinian Territories.

Custom graphic. Scatter plot demonstrating that people in richer countries rate their lives better. Wellbeing ratings are plotted along with countries' economic output, and circles representing countries vary in size according to country population.

While this discovery appears to contradict one of Easterlin's conclusions, Deaton attempted to reconcile both findings. People's life ratings may still be relative. Instead of comparing their lives to their neighbors', they compare their lives to people's lives around the world. In his words, it is possible that "… Danes understand how bad life is in Togo and other poor places, and the Togolese, through television and newspapers, understand how good life is in Denmark or other high-income countries."

Are Danes high on life because they see global poverty and know they have it so much better? Or is Deaton's finding direct evidence that money does lead to a better life?

Happiness May Not Be Happiness

Here is where things get complicated. What many economists call "happiness" may not actually be "happiness." Most of the previous research focused on how people see their lives (life evaluation), not on how they live their lives (life experiences). In partnership with Kahneman, Deaton wrote another paper examining these differences.

In this study, they used Gallup's daily wellbeing survey in the U.S. Because we were calling 1,000 people every day, we had data on roughly 350,000 Americans each year. We asked people to rate their lives and to report how much they smiled and laughed a lot yesterday or whether they experienced a lot of stress, sadness, and anger. We also asked people how much money they make.

Using Gallup's income variable, Kahneman and Deaton found that the more money people make, the higher they rate their lives. In fact, there did not appear to be a satiation point. Meaning, money never stops affecting how well you see your life.

You might think, "There it is -- money does buy happiness." That is true, but only if you believe that true "happiness" is defined by how you see your life. If you think happiness is how you live your life -- how much you laugh and smile or how little anger you experience -- then this study does not support the theory that money buys happiness.

When the authors looked at the relationship between income and reports of stress, anger, sadness, or enjoyment, they found a much weaker link. Beyond $75,000 of annual salary, income had almost no effect on how people lived their lives. Once your basic needs are met, money cannot buy laughter or a stress-free life.

Remember, this study was conducted in the U.S., and money may affect Americans differently. Although according to University of Michigan economists Betsey Stevenson and Justin Wolfers, Deaton and Kahneman's finding does apply globally. Looking at similar data across the world, the principle still holds: The more money people make, the higher they rate their lives. In fact, they believe that money's effect on life evaluation never satiates. "If there is a satiation point, we are yet to reach it," they say.

Academics at the University of Virginia and Purdue University disagree. Using the same Gallup World Poll data, they did a similar analysis but controlled for household size (an income of $95,000 may go further if you are single than if you have four kids). They also did not omit some of the highest incomes in the database.

They found that income's influence on life evaluation did satiate: Beyond $95,000 of annual income, people stop rating their lives better. If anything, incomes that are too high may cause people to see their lives worse in some parts of the world.

Why would more money make people rate their lives worse? According to the authors:

Theoretically, it is presumably not the higher incomes themselves that drive reductions in [wellbeing], but the costs associated with them. High incomes are usually accompanied by high demands (time, workload, responsibility and so on) that might also limit opportunities for positive experiences (for example, leisure activities). Additional factors may play a role as well, such as an increase in materialistic values, additional material aspirations that may go unfulfilled, increased social comparisons or other life changes in reaction to greater income (for example, more children or living in more expensive neighborhoods). Importantly, the ill effects of the highest incomes may not just be present when one's maximum income is finally reached, but could also occur in the process of its attainment.

To summarize, money influences how people see their lives much more than how they live their lives, but only after their basic needs are met. While there is disagreement about how much it affects how they see their lives, everyone seems to agree -- money matters. This is why one of the five elements of wellbeing is financial wellbeing.

To further emphasize the extent to which money influences how people see their lives, consider the effect of economic fluctuations on people's wellbeing.

People are loss averse. Or, as Los Angeles Dodgers broadcaster Vin Scully used to say, "Losing feels worse than winning feels good."

This is how loss aversion works: If you lose $20 and find $20 in the same day, economically, you are whole. But emotionally, you are not. Losing $20 causes pain that finding $20 does not make up for.

Loss aversion affects entire countries the same way it affects individuals. Oxford economist Jan-Emmanuel De Neve and his colleagues looked at how life evaluation fluctuates based on economic expansions and contractions. An economic contraction causes life ratings to drop far more than an economic boom causes life ratings to increase. According to the authors, "… life satisfaction of individuals is between two and eight times more sensitive to negative growth as compared to positive economic growth. People do not psychologically benefit from expansions nearly as much as they suffer from recessions."

Their recommendation? Policymakers should do everything they can to create slow, consistent growth -- because the wild swings of economic busts and booms leave countries worse off emotionally. This is true even if those wild swings lead to greater national wealth than is created by slow consistent growth.

While there is disagreement about how much it affects how they see their lives, everyone seems to agree -- money matters.

Of course, economic growth is distinct from personal financial growth. A growing economy may not benefit everyone. Additionally, money's impact on an individual is often examined through their income and not their overall financial situation, including their debt. Someone can make a lot of money, but that doesn't mean their finances are in good shape.

My colleagues Stephanie Marken and Andrew Dugan reviewed a massive Gallup survey of U.S. college graduates to answer one question: How does college debt affect people's wellbeing?

Not surprisingly, debt is bad. But college debt has lasting effects. Stephanie and Andrew found that college debt leaves an emotional scar on people even after they pay off the debt. Imagine a hardworking American who took out loans to pay for college. Then they graduated, got a good job, managed their finances perfectly, and finally paid off their debt. They are now in a good place financially, but they still have another deficit -- an emotional one that may linger for a long time.

According to Stephanie and Andrew, "Studies show that high student debt can result in the deferral of major life events, such as marriage and homeownership. High student debt can also result in a graduate pursuing a career path he or she would not have taken otherwise."

How People Feel About the Money They Make

We know that money matters. So how is the world's financial wellbeing? According to more than 2 billion adults -- not good.

Gallup asks the world:

Which one of these phrases comes closest to your own feelings about your household income these days? Living comfortably on present income, getting by on present income, finding it difficult on present income, or finding it very difficult on present income.

From 2019-2021, 19% of people said they lived comfortably on their present household income, 41% said they were getting by, 23% said they found it difficult, and 16% found it very difficult. This translates into an estimated 1.2 billion people who find it difficult to get by on their current income and 860 million who find it very difficult -- meaning there are over 2 billion people who are really struggling financially.

The U.S. ties for eighth globally for number of people who say they live comfortably on their present income. Despite being one of the highest countries on the list, the U.S. still has 6% of people who report the least satisfaction with their income -- finding it very difficult to get by.

But are these 6% of Americans dissatisfied with their income because they cannot pay their bills -- or are they unhappy with their income because it is low relative to other Americans' income? Or both?

Absolute Income vs. Income Inequality

According to the OECD, which analyzed Gallup World Poll data, "Income difficulties appear to be closer to an absolute than a relative equity measure, at least within the OECD." The OECD finds that while there is a significant relationship between income inequality and Gallup's subjective income question, the relationship is stronger between absolute household income and subjective income.

These correlations are true globally as well; "income difficulties" appear to correlate more strongly with absolute income than with income inequality.

But, according to my colleague Pablo Diego-Rosell, who has analyzed Gallup's subjective income measure more than anyone, the measure may be more nuanced. In his words, "This measure is the single most important driver of both life evaluations and experienced wellbeing. My hypothesis is that it is so important because it jointly accounts for all the direct and indirect effects of income, including income relative to others (social comparison) or to one's past income (habituation)." He further says, "Subjective material wellbeing and its objective determinants, including economic growth and income inequality, should remain at the center of the research and policy agenda."

Knowing the extent of income inequality and absolute income's influence on wellbeing better positions leaders to improve people's lives. If the source of a bad life comes a little more from absolute income than from income inequality, policy experiments such as a universal basic income (UBI) may be helpful to improve the lives of the more than 2 billion people who are struggling on their present income.

One of the most famous experiments involving UBI took place in Finland. The government tested a basic income with a group of people who were chronically unemployed. After following 2,000 participants for two years, the government found that the additional income made people rate their lives higher. This study has been replicated in at least 16 other studies globally with similar results, according to the Stanford Basic Income Lab.

UBI may have a positive impact on people's wellbeing, but that does not necessarily mean it is the best policy. Critics are understandably concerned about how UBI programs get funded and the potential impact on people's desire to work.

But regardless of the politics surrounding UBI, it is important to conduct policy experiments that attempt to improve people's financial wellbeing -- precisely because of how much financial wellbeing affects a person's overall wellbeing.