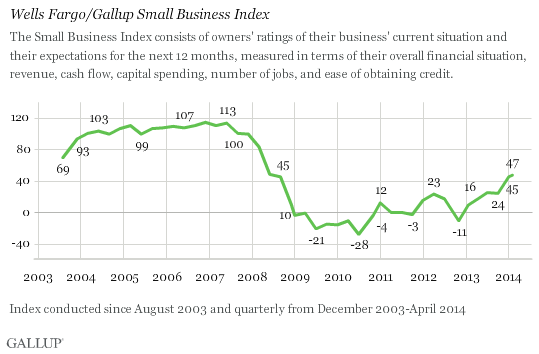

PRINCETON, NJ -- U.S. small-business owners' optimism about their businesses continues to grow, with the Wells Fargo/Gallup Small Business Index rising slightly to +47 in the second quarter of 2014, up from +45 in the first quarter. The index is now at its highest level since 2008, although it is still significantly lower than in the pre-recession years from 2003 through 2007.

These results are from the most recent update of the Wells Fargo/Gallup Small Business Index, based on telephone interviews with 600 small-business owners conducted March 31-April 4, 2014.

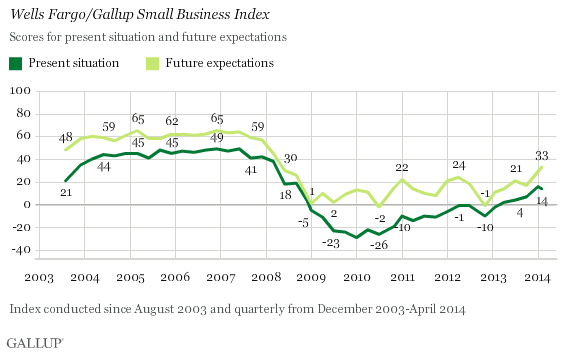

The rise in the index in late March and early April is the result of an increase in the future expectations score, based on owners' responses to a series of questions about anticipated conditions over the next 12 months. This score is now at +33, higher than at any point since the start of 2008. The present situation score, based on owners' assessments of their current situation, had jumped significantly in the first quarter, but has since decreased slightly to +14. Small-business owners' future expectations and assessments of their present situation nevertheless remain well below pre-recession levels.

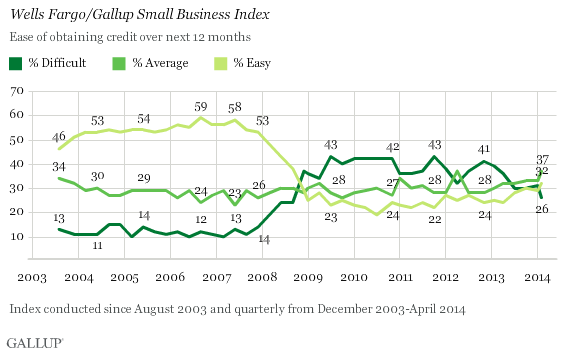

One factor that has contributed to the uptick in small-business owners' optimism is their more positive attitudes about their ability to obtain credit. At this juncture, 32% of owners say it will be easy to obtain credit over the next year -- up from 29% in the previous quarter -- while another 37% say it will be about average. At the same time, 26% say it will be difficult to obtain credit; this is the lowest percentage recorded since the third quarter of 2008.

From a longer-range perspective, there have been extreme shifts in small-business owners' views of credit since 2003. Up until 2008, about half or more of small-business owners felt that obtaining credit was easy. That changed dramatically as the recession unfolded, with the percentage saying that credit would be easy to obtain dropping to a low of 19% in the third quarter of 2010. The current view of credit availability thus represents a near-term improvement, but is far removed from the much more positive pre-recession era outlook.

Implications

U.S. small-business owners continue to recover from the major body blows suffered during the Great Recession. Owners' assessments of both their present situation and expectations for the future have recovered from lows registered in previous years, and the Wells Fargo/Gallup Small Business Index is now as high as it has been since 2008. However, attitudes have yet to recover to where they were pre-recession, and even if the current rate of improvement continues, it will be a long time until owners regain the optimism levels of 10 years ago.

Some of the more prominent political debates at the state and federal levels involve proposed policy changes relating to healthcare, immigration, and the minimum wage -- all of which could have profound effects on small-business owners. The outcome of these debates could dictate whether small-business owners become more positive or negative in the coming years. Still, the fundamental need for any small business is actual customers willing to spend dollars, and the changes in dollars spent in the months ahead remain the most important factor likely to affect owners' views.

About the Wells Fargo/Gallup Small Business Index

Since August 2003, the Wells Fargo/Gallup Small Business Index has surveyed small-business owners on current and future perceptions of their business' financial situation. The index consists of two dimensions: 1) owners' ratings of the current situation of their businesses, and 2) owners' ratings of how they expect their businesses to perform over the next 12 months.

The overall Small Business Index is computed using a formula that scores and sums the answers to 12 questions -- six about the present situation and six about the future. An index score of 0 indicates that small-business owners, as a group, are neutral -- neither optimistic nor pessimistic -- about their companies' situation. The overall index can range from -400 (the most negative score possible) to +400 (the most positive score possible), but in practice spans a much more limited range. The highest index reading was +114 in the fourth quarter of 2006, and the lowest reading was -28 in the third quarter of 2010.

For more information about Wells Fargo Works for Small Business, visit WellsFargoWorks.com.

Survey Methods

Results for the total data set are based on telephone interviews conducted March 31-April 4, 2014, with a random sample of 600 small-business owners, living in all 50 U.S. states and the District of Columbia.

For results based on the total sample of small-business owners, the margin of sampling error is ±4 percentage points at the 95% confidence level.

Sampling is done on a random-digit-dial basis using Dun & Bradstreet sampling of small businesses having $20 million or less in sales or revenues. The data are weighted to be representative of U.S. small businesses within this size range nationwide.

In addition to sampling error, question wording and practical difficulties in conducting surveys can introduce error or bias into the findings of public opinion polls.

For more details on Gallup's polling methodology, visit www.gallup.com.