Story Highlights

- Financial services firms say their customer experience (CX) is unique, but few are

- Firms must go beyond service- to culture-minded to truly elevate the CX

- Mature across five horizons to achieve world-class CX and corresponding business results

Over the past decade, financial services firms have positioned the customer's experience as a way to enhance the firm's brand promise and differentiate their firm against competitors. While some organizations have always operated with a "customer-centric" approach, it's in vogue today -- many leaders wonder where this customer-centric journey will lead them.

Complicating matters for financial services firms is the rapid adoption of digital products and services intended to complement human service delivery channels, creating many more customer journeys that can delight or detract.

Progressive and visionary leaders paint a highly aspirational vision for the future, whereby the customer is so central to the firm's mission and purpose that "customer experience" becomes the singular and dedicated focus for the entire organization and positive business results flow from this focus.

Gallup has identified this paradigm shift as a desire to create a "culture of customer experience."

Building a culture of customer experience (CCX) is an attainable destination for every organization on its customer experience journey. If you want long-term organic growth in your business, you must make a long-term commitment to your customer, and achieving that goal requires a commitment to striving for CCX.

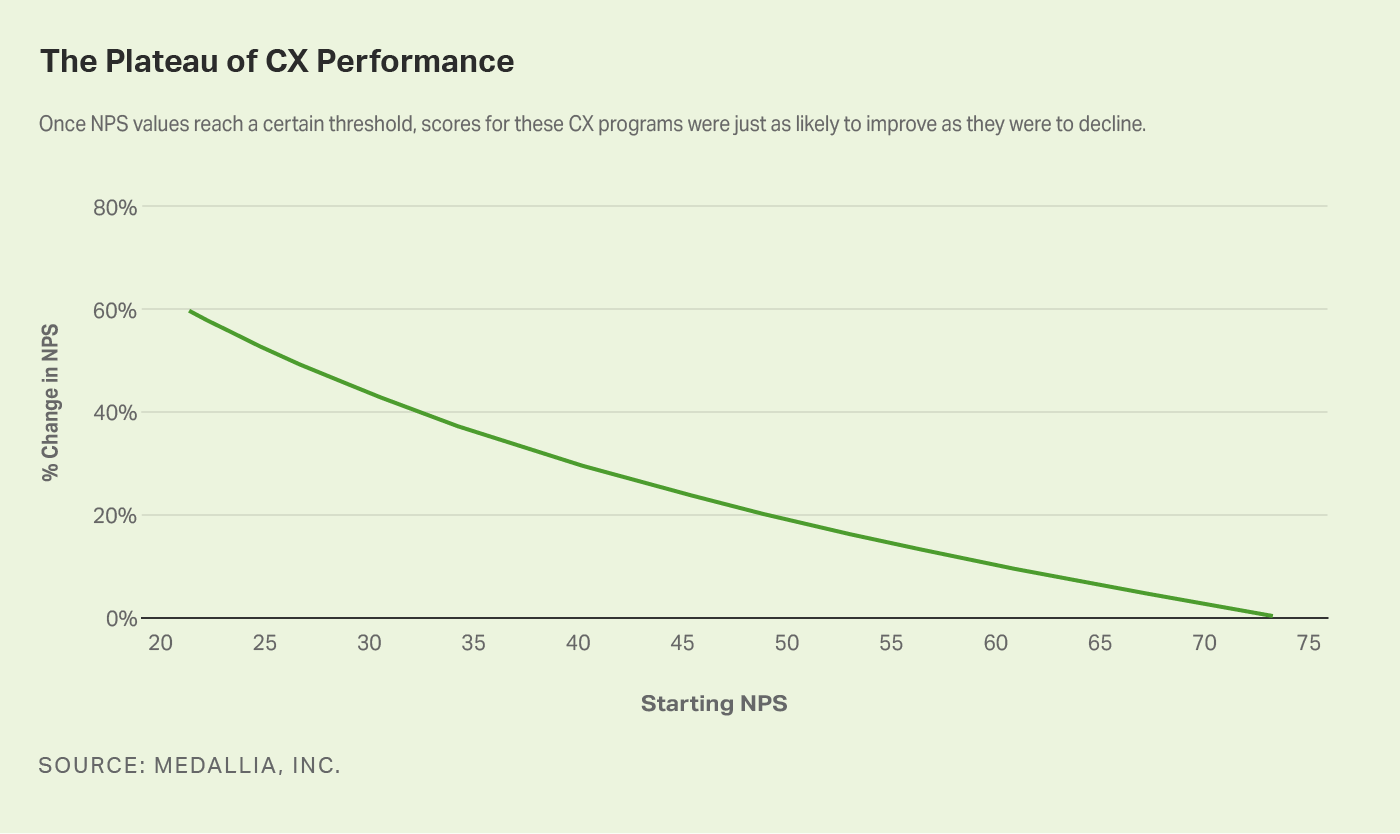

Most organizations initially invest time and attention in fixing problems and easing friction for customers -- that is, preventing the downside of the customer experience (CX). These efforts to consistently meet customers' basic expectations generate productive returns for a time, but they eventually slow and plateau. If your only means to improve CX is by fixing problems, you're limited to intervening and improving CX only for that segment of the customer population experiencing problems -- a segment that hopefully will grow smaller over time if problems are resolved in a responsive and satisfactory way.

Custom graphic. Line graph comparing the percent change in NPS over time with the starting NPS for financial institutions. Once NPS values reach a certain threshold, scores for these customer experience programs were just as likely to improve as they were to decline - in other words, CX performance plateaus over time. Medallia, Inc. provided these data.

In fact, Gallup's 2018 Retail Banking Study found that the percentage of overall problems customers experience is under 10%, on average, for top-performing financial institutions. Problems are manageable with effort, but to drive an upside and find room for continued growth, organizations must focus on other CX factors or be relegated to the inherent limitations that come with preventing downsides.

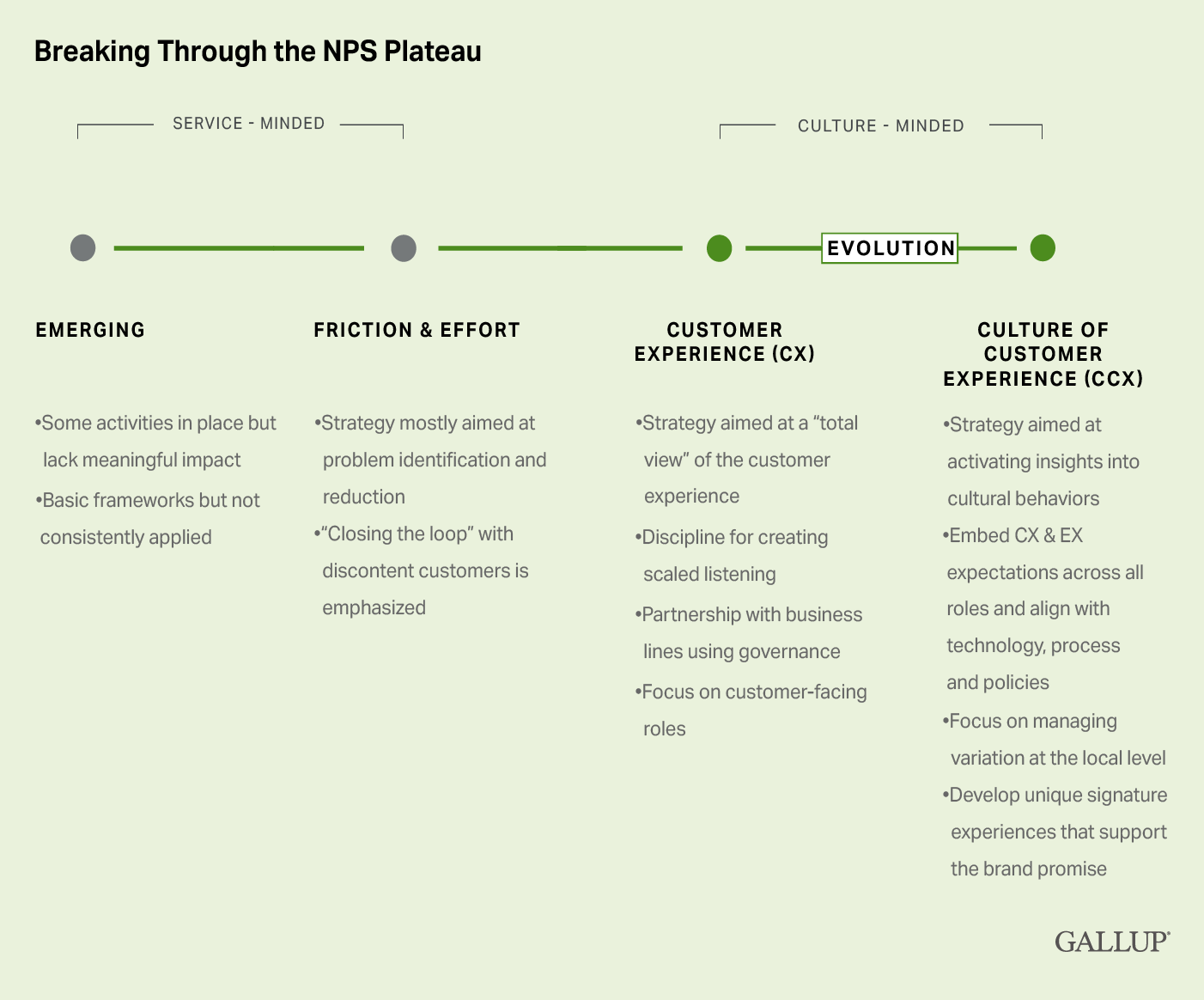

To break through the plateau, organizations must evolve their focus beyond serviceability -- that is, consistently meeting customers' basic expectations -- and enable culture.

If you want long-term organic growth in your business, you must make a long-term commitment to your customer, and achieving that goal requires a commitment to striving for CCX.

Moving to a culture-minded approach, as opposed to a service-minded one, nets lasting benefits for organizations that are willing to put in the effort. Leading with culture means everyone in the organization works seamlessly to build deeper relationships with customers and collectively deliver on the brand promise. A culture-minded approach nurtures innovation and empowers employees to discover new, unmet customer needs. By anticipating and meeting customer needs as they arise while consistently delivering to customers in every channel, organizations can create engaging experiences often while also unearthing opportunities for organic growth with existing customers.

Custom graphic. A graphic that describes how financial institutions can evolve to break through the NPS plateau by shifting from being service-minded to being culture-minded. Most organizations start with emerging behaviors that include putting some activities in place but lack meaningful impact and basic frameworks that are not consistently applied. Then service-minded moves to friction and effort in which strategy is mostly aimed at problem identification and reduction, and "closing the loop" with discontent customers is emphasized. Institutions that evolve their approach to be culture-minded can then move into customer experience (CX) where the strategy is aimed at a "total view" of the customer experience, there is the discipline for creating scaled listening, a partnership with business lines using governance, and a focus on customer-facing roles. And then the final step of evolution to break through the NPS plateau is achieving a culture of customer experience (CCX), which includes a strategy aimed at activating insights into cultural behaviors, embedding CX and EX expectations across all roles and aligning with technology, process, and policies. CCX also includes a focus on managing variation at the local level and developing unique signature experiences that support the brand promise.

This is in stark contrast to the more traditional service-minded approach that tends to focus on isolated moments, whether it's a transaction or a customer who needs help resolving a problem. Organizations that are service-minded make sure their customers' functional needs are met but likely aren't delivering a cohesive experience to customers and certainly aren't anticipating their needs and identifying opportunities.

Organizations that move to a culture-minded approach using an omnichannel view ensure that the customer is always at the forefront.

Your Culture of Customer Experience Strategy

But how does an institution even begin to approach a transition like this? Through Gallup's client engagements and advisory services with leading financial services organizations, our experts identified Five Guiding Principles of CCX that are necessary for a successful shift from a service-minded perspective to a culture-minded one:

- Inspire and broaden ownership. Customer focus and commitment starts at the top of the organization and cascades to all levels.

- Data drive decisions. Data, facts and insights drive business decisions.

- Commit to learn and adapt. Learn, experiment, improve and change at the organizational, team and individual levels.

- Think locally. The focal point of CCX is to and through the customer-facing employee.

- Address limits and constraints. CCX is sustained by integrating key processes and enabling systems while assessing and acknowledging current limitations.

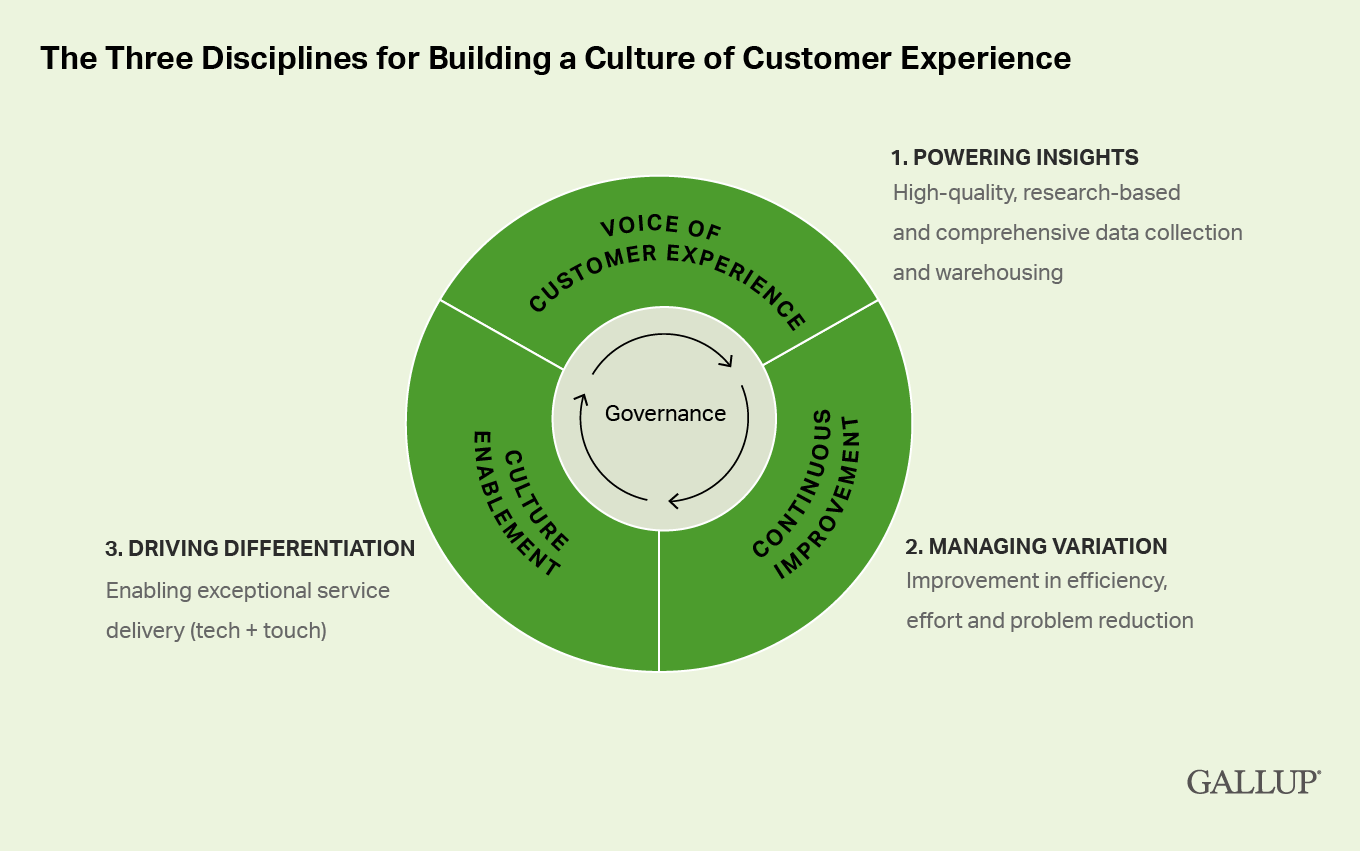

These principles are meant to help leaders guide planning and actions as they work their way through three core CCX disciplines.

Custom graphic. A graphic illustrating the three disciplines for building a culture of customer experience. It starts with using the voice of customer experience to power insights - this means high-quality, research-based, comprehensive data collection and warehousing. The second step is to seek continuous improvement by managing variation - this means improvement in efficiency, effort, and problem reduction. The last component of this circular cycle is culture enablement through driving differentiation - this means enabling exceptional service delivery via both human touch channels and technology. And at the center of this circle is Governance.

It's important to note that governance plays an integral role in all of this -- directing and managing the guiding principles and disciplines. Governance is the center of excellence at the enterprise level and is responsible for customer experience strategy, programs, measurement and partnership across the organization to continuously drive CCX.

A culture-minded approach nurtures innovation and empowers employees to discover new, unmet customer needs.

Further, this center designs measurement standards and manages the forums that hold leaders accountable for acting on customer feedback. Effectively, governance is the lever that ensures an omnichannel view of CX. Without things like senior leadership buy-in and ongoing alignment, metrics and dashboards, project management, etc., efforts to achieve CCX will be forever sporadic and siloed.

With the above framework, Gallup helps its clients establish capabilities across these three disciplines through an intentional, strategic maturation path that leads to CCX.

Navigate Through Five Horizons to Transform Your Organization and Drive Growth

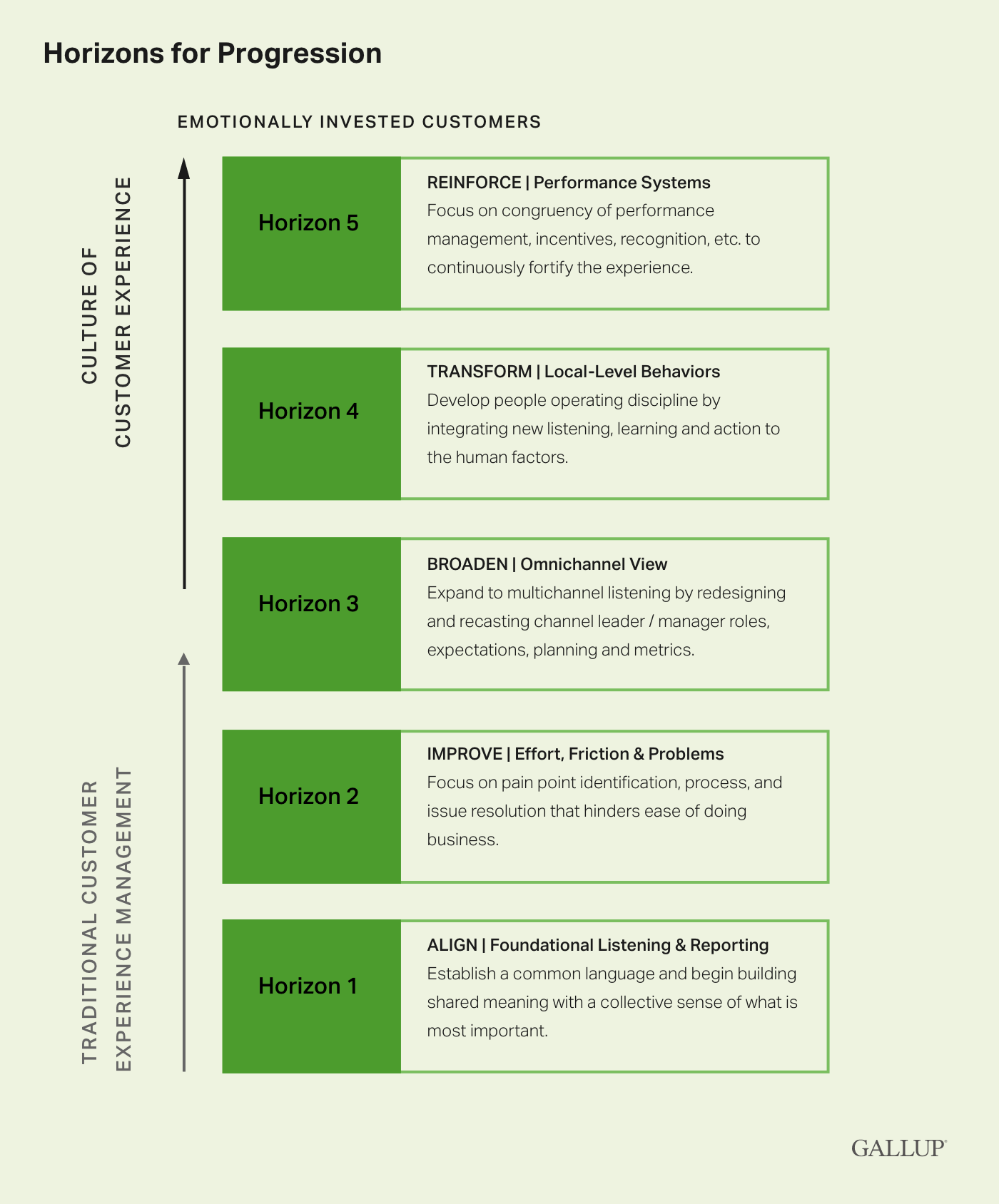

Progress toward true CCX is achieved and sustained through technology enablement combined with executive commitment, strategy, discipline, analytics and action. Organizations should work progressively and maturate their CX programs through five horizons:

Custom graphic.

This graphic represents the five horizons financial institutions can progress through to achieve emotionally invested customers. An organization using traditional customer experience management is likely on horizon 1 or horizon 2.

Horizon 1: Align through foundational listening and reporting: Establish a common language and begin building shared meaning with a collective sense of what is most important.

Horizon 2: Improve effort, friction and problems: Focus on pain point identification, processes, and issue resolution that hinders ease of doing business.

Horizon 3: Broaden to an omnichannel view: Expand to multichannel listening by redesigning and recasting channel leader/manager roles, expectations, planning and metrics.

Horizon 4: Transform the local level behaviors: Develop people operating disciple by integrating new listening, learning and action to the human factors.

Horizon 5: Reinforce performance systems: Focus on congruency of performance management, incentives, recognition, etc., to continuously fortify the experience.

Organizations that reach horizon 4 and horizon 5 are achieving a culture of customer experience.

Financial services organizations that Gallup has partnered with achieve an average 50 NPS, compared with the industry average of 16 recorded in Gallup's 2021 Retail Banking Study.

Gallup helps organizations take the right actions at the right time to achieve sustained CX success. This enables organizations to earn above-industry-average CX performance scores through more emotionally invested customers while avoiding stagnation or inconsistent CX across channels. Through these intentional efforts to shift to a culture-minded approach, organizations will find continued above-average CX achievement.

Curious where your organization stands on CCX?

- Contact Gallup to receive a CCX Diagnostic that helps leaders assess their current state and opportunities for improvement.

- Subscribe to get Gallup's latest financial services insights and discoveries sent right to your inbox.