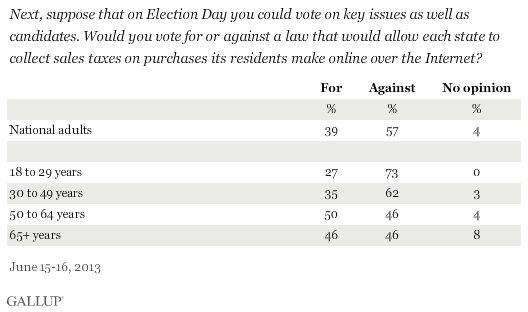

WASHINGTON, D.C. -- Americans, by 57% to 39%, say they would vote against a law that would allow each state to collect sales taxes on purchases its residents make online over the Internet. Young adults voice the most widespread opposition to such a law.

The Senate passed an Internet sales tax bill, the Marketplace Fairness Act, last month on a bipartisan basis, but it has yet to pass the House. This legislation would allow states to require online sellers to collect sales taxes, which would go to state and local governments. The legislation would apply to online retailers earning at least $1 million in sales outside of states where they have brick-and-mortar locations. Currently, online retailers do not have to collect sales taxes on Internet purchases unless they have a physical presence in the state.

This legislation faces more opposition in the House than it did in the Senate, with numerous members, including House Speaker John Boehner, criticizing it. The White House has announced that the president supports the legislation.

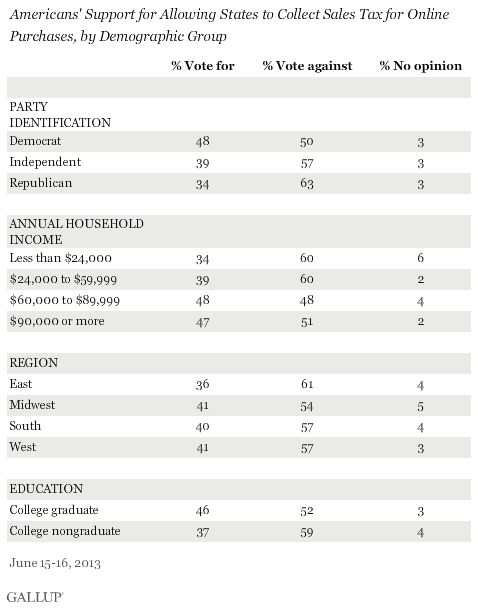

Internet Sales Tax Fails to Get Majority Support From Any Group

The majority of Americans across nearly all key groups oppose an Internet sales tax law, but there are modest differences in the degree of support. Democrats are somewhat more likely than Republicans to favor an Internet sales tax, 48% to 34%. College graduates are slightly more likely than those without a college degree to support it, 46% to 37%. And support is higher among adults in households making $60,000 or more annually than among those in lower-income households.

Bottom Line

The U.S. Senate recently passed a bill empowering states to require online retailers to collect sales tax, and President Barack Obama will likely sign such a bill if the House passes it. But this goes against the grain of public opinion, possibly stemming from standard concerns about the economic impact that raising taxes will have on individuals and businesses.

Unlike many political and economic issues, reaction to the idea of an Internet sales tax law does not appear to be sharply divided along party lines, either in Congress or among the general public. This proposal does not have majority support among any partisan group, although -- possibly due to Obama's support for it -- Democrats are more likely than Republicans to favor it, by a relatively narrow margin.

Age largely shapes Americans' views on taxing Internet sales. Younger Americans are much more likely than older Americans -- who are closely split -- to oppose such a law. If Republicans in the House oppose the Internet sales tax bill, that may help the GOP's appeal to younger Americans, a key demographic in the party's plans to build support before the 2014 and 2016 elections.

Survey Methods

Results for this Gallup poll are based on telephone interviews conducted June 15-16, 2013, on with a random sample of 1,015 adults, aged 18 and older, living in all 50 U.S. states and the District of Columbia.

For results based on the total sample of national adults, one can say with 95% confidence that the margin of sampling error is ±4 percentage points.

Interviews are conducted with respondents on landline telephones and cellular phones, with interviews conducted in Spanish for respondents who are primarily Spanish-speaking. Each sample of national adults includes a minimum quota of 50% cellphone respondents and 50% landline respondents, with additional minimum quotas by region. Landline telephone numbers are chosen at random among listed telephone numbers. Cellphone numbers are selected using random digit dial methods. Landline respondents are chosen at random within each household on the basis of which member had the most recent birthday.

Samples are weighted to correct for unequal selection probability, nonresponse, and double coverage of landline and cell users in the two sampling frames. They are also weighted to match the national demographics of gender, age, race, Hispanic ethnicity, education, region, population density, and phone status (cellphone only/landline only/both, cellphone mostly, and having an unlisted landline number). Demographic weighting targets are based on the March 2012 Current Population Survey figures for the aged 18 and older U.S. population. Phone status targets are based on the July-December 2011 National Health Interview Survey. Population density targets are based on the 2010 census. All reported margins of sampling error include the computed design effects for weighting.

In addition to sampling error, question wording and practical difficulties in conducting surveys can introduce error or bias into the findings of public opinion polls.

View methodology, full question results, and trend data.

For more details on Gallup's polling methodology, visit www.gallup.com.