Story Highlights

- Most mergers and acquisitions fail

- It's all too common for deal-makers to ignore organizational culture

- Deep dives into the cultures of both the acquiring and acquired companies are vital

In just the first five months of 2021, M&A activity shattered all previous highs: Global mergers and acquisitions totaled $2.4 trillion for January through May, up by 158% from the same period last year. Acquisitions by special purpose acquisition companies (SPACs), which raise capital through IPOs to buy existing companies, hit a record-high $348 billion as well.

Unfortunately, many of those M&As won't pan out -- 70% to 90% of merged companies fail, according to Harvard Business Review -- even though those deals cost a fortune. In the first five months of 2021 alone, global M&As cost companies between $24 billion and $168 billion.

Considering the costs, the odds, and that a SPAC's value both depends on and creates its sponsors' reputation, leaders need more from their due diligence than the basic HR, financial, contracts, tax and insurance intel. Important though it is, that information doesn't scratch the surface of culture.

And it's culture that makes or breaks an M&A.

Will you have a culture match or culture clash?

Gallup describes culture as "the way we do things around here." All companies do things differently -- but Michele Gelfand, professor of psychology at the University of Maryland and author of Rule Makers, Rule Breakers: How Tight and Loose Cultures Wire Our World, says a culture can be categorized as either tight, in which "the way we do things" emphasizes norms and compliance, or loose, in which norms and compliance are weakly enforced.

Tightness isn't a quality that deal teams typically measure or underwriters examine, but they should. When tight cultures merge with loose cultures, their return on assets tends to decrease by an average annual $200 million in net income three years after the merger. Those with especially large cultural mismatches see their yearly net income drop by more than $600 million.

For a real-life example, look no further than Google's $3.2 billion purchase of Nest. Google's loose, engineering-led structure never fit Nest's tight leadership culture, and eventually Nest's founders quit and the acquisition generated little in the way of profit or products.

That's not unusual. Culture clashes are practically the norm because culture is so complex, multilayered and difficult to understand -- Gelfand calls culture both omnipresent and invisible. In fact, culture is so difficult to conceptualize and operationalize that most employees don't relate to their own company's values. Gallup finds that only 23% of U.S. employees strongly agree that they can apply their organization's values to their work every day, and only 27% strongly agree that they believe in their organization's values.

Culture clashes are practically the norm because culture is so complex, multilayered and difficult to understand.

That's alarming for a lot of reasons, one of which is that employees of a merged company must stay productive during cultural change. Kison Patel, CEO and founder of DealRoom, contends that "given the value that human capital represents in most modern organizations, there's a high inherent risk of value destruction" if employees' needs and cultural expectations aren't considered in a transaction.

For that reason, Gallup recommends that leaders think of culture and work style as two different things. To wit:

- Organizational culture, or how the target company "does things around there." Are norms tightly enforced? Or are they loosely applied?

- Work style, or how the organization prefers to distribute and complete the work. Do work orders flow down the org chart? Or is autonomy granted -- and if so, to whom?

With that bipartite view, leaders can start to ask the right questions of the right people early in the process. Gallup finds that helps predict future behavior, especially when leaders or deal teams focus on purpose, strategy, culture, brand and the employee experience. Specifically:

- Purpose: why the company exists and why employees think it exists

- Strategy: what the company is building

- Culture: how work gets done

- Brand: how the company is seen internally by all levels of employees and externally by customers and prospective customers

- Employee experience: how employees get work done, their level of engagement and their expectations of their leaders

That penetrating look needs to go both ways -- leaders must also examine their own DNA and identify similarities, synergies and differences between the two companies.

To that end, Gallup recommends that leaders ask themselves:

- Purpose: What hopes and aspirations do we share?

- Strategy: How aligned are our growth strategies?

- Culture: What are some shared values, norms and rituals?

- Brand: What elements are common, what are differentiated, and where do we have competitive differentiation?

- Employee experience: Are there commonalities in the way employees experience work? Are there differences? What causes them?

That's a key strategy for Alimentation Couche-Tard's M&As. And the 14,000-location convenience store chain does a lot of them, doubling in size every five years. "We're always looking for the one or two or five things that a company is excellent at that we don't do," says Chief People Officer Ina Strand in a recent Gallup CHRO Conversation. "It's just part of our learning orientation and our openness to new ideas."

Those questions may turn up more lines of inquiry that can have enormous downstream impact. For instance, it's vital to involve functional teams early -- deals have fallen apart because of siloed processes and lack of communication -- but each team's purpose may not be clear. It's worth the effort to determine and articulate the purpose that motivates functional teams.

Tightness isn't a quality that deal teams typically measure or underwriters examine, but they should.

Or, take integrated solutions strategies. They're only as effective as the people spearheading them, and people are most effective when they're emotionally engaged. Determining both sides' level of employee engagement can inform solutions strategies in the short term and have decisive impact on the M&A's long-term success.

Align leaders from the very start.

This approach to due diligence, perhaps more appropriately called cultural due diligence, should include an analysis of differences in leadership. McKinsey says that 95% of executives describe cultural fit as critical to the success of integration -- but EY research shows that 75% of people in key roles quit within three years, on average, post-merger.

That demonstrates how often leaders are culturally misaligned, or become so.

And the fact is, most of the time, the acquiring company's leadership team takes charge. Whether loose or tight, those leaders influence the newly merged company's overall culture, which may erase the purpose, strategy, culture, brand and employee experience attributes that would have enabled the merger to succeed.

So regardless of the structure, it's imperative to align leaders from the start. Again, their cultural expectations may not be clear, even to them -- specifically during times of significant disruption. Gallup recommends assessing the two leadership teams' expectations and combining their guiding principles and examining leaders' expectations to map their motivations and equip them with a common vocabulary and foundation for building trust.

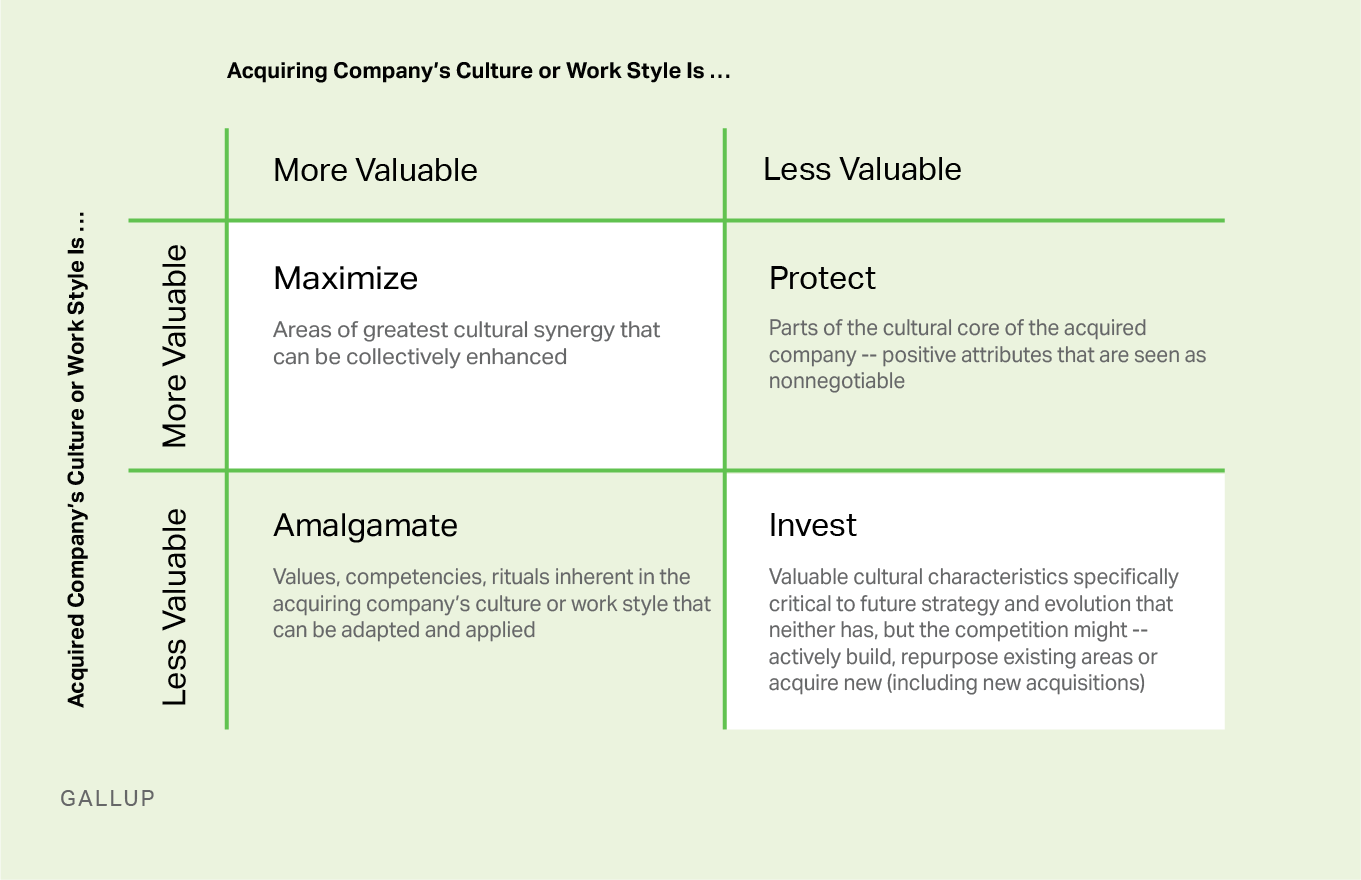

A key element of that diagnostic activity is to study the unique culture of the two companies. The analysis helps leaders identify the most valuable aspects of the acquired company's culture, the qualities that must be maximized and protected. Other aspects will be seen as less valuable to the merged company in the future, but are still important to the acquiring company. Those can be amalgamated into the new expanded culture. Finally, the exercise will indicate cultural qualities that neither organization has -- but will need to be competitive.

Custom graphic. If the acquiring company's Culture or Work Style Is highly Valuable, maximize Areas of greatest cultural synergy that can be collectively enhanced, and amalgamate Values, competencies, rituals inherent in the acquiring company's culture or work style that can be adapted and applied. If the acquired company's culture or work style is more valuable, invest in Valuable cultural characteristics specifically critical to future strategy and evolution that neither has, but the competition might -- actively build, repurpose existing areas or acquire new (including new acquisitions).

That deeper, more nuanced understanding helps leaders develop a post-merger integration strategy -- in brief, culture alignment -- as well as develop a road map for change. It is also critical for broader leadership buy-in and informed decision-making that can help evaluate and execute key work style or technology implementation, learning or innovation focus.

Use a culture framework that works.

Getting culture right is key to successful mergers. Indeed, Accenture found that 75% of CEOs say "the COVID-19 crisis" has made the talent and cultural aspects of an M&A even more important than they used to be. "Appreciating cultural differences is paramount to the success of a deal," says Accenture's managing director of strategy, talent and organization in North America, Katherine LaVelle. "Companies who pass over them pay a steep price."

Clearly, the stakes are high, and with this much M&A activity, they're getting higher. Mergers collapse when leaders fail to understand the cultural imperatives of the union of two organizations -- or recognize that culture is omnipresent, invisible, complex and multilayered. An executive debrief will never get to the bottom of that.

But a framework that recognizes culture and work style as two different things and critically examines purpose, strategy, culture, brand and the employee experience -- in tandem with other operational and financial measures -- gives M&As the best chance of success.

Learn about culture to make mergers and acquisitions more successful:

- Download our paper to discover the five drivers of culture.

- Partner with Gallup to analyze, combine and improve culture.

- Read more right now. Learn how culture affects business performance.