Over and over, Gallup financial industry studies show credit unions out-engage banks.

Indeed, our 2018 Financial Services Study showed that credit unions' percentage of highly engaged members is 11 percentage points higher than that of the market overall, and 22 points higher than national banks in general.

On top of that, credit union members are more loyal, their NPS scores are higher, and when Gallup asks why people have a great deal of confidence in their financial institution -- of any sort -- one of the top answers is simply:

"They look out for my financial wellbeing."

CommunityAmerica, a Kansas City-based credit union, is proof of that sentiment. It's been measuring and meeting members' engagement needs for years in the way credit unions typically do: very well.

"It's in our DNA, that sensitivity to our members' needs, that drive to respond," says Missy Agee, CommunityAmerica's Director of Performance Tracking.

It's no surprise then that CommunityAmerica has one of the most engaged memberships in the Callahan-Gallup Collaborative Financial Wellbeing and Member Engagement Program, which is a collaborative initiative to drive credit union member engagement consisting of eight credit unions with a combined 3.2 million members.

Then came the pandemic, which Chief Financial Officer Tim Saracini describes as, "a moment of truth, when you can have the greatest impact, when you have to put yourself in the member's shoes and feel what they feel."

CommunityAmerica was more than ready -- indeed, its knowledge of members' feelings allow it to anticipate their needs.

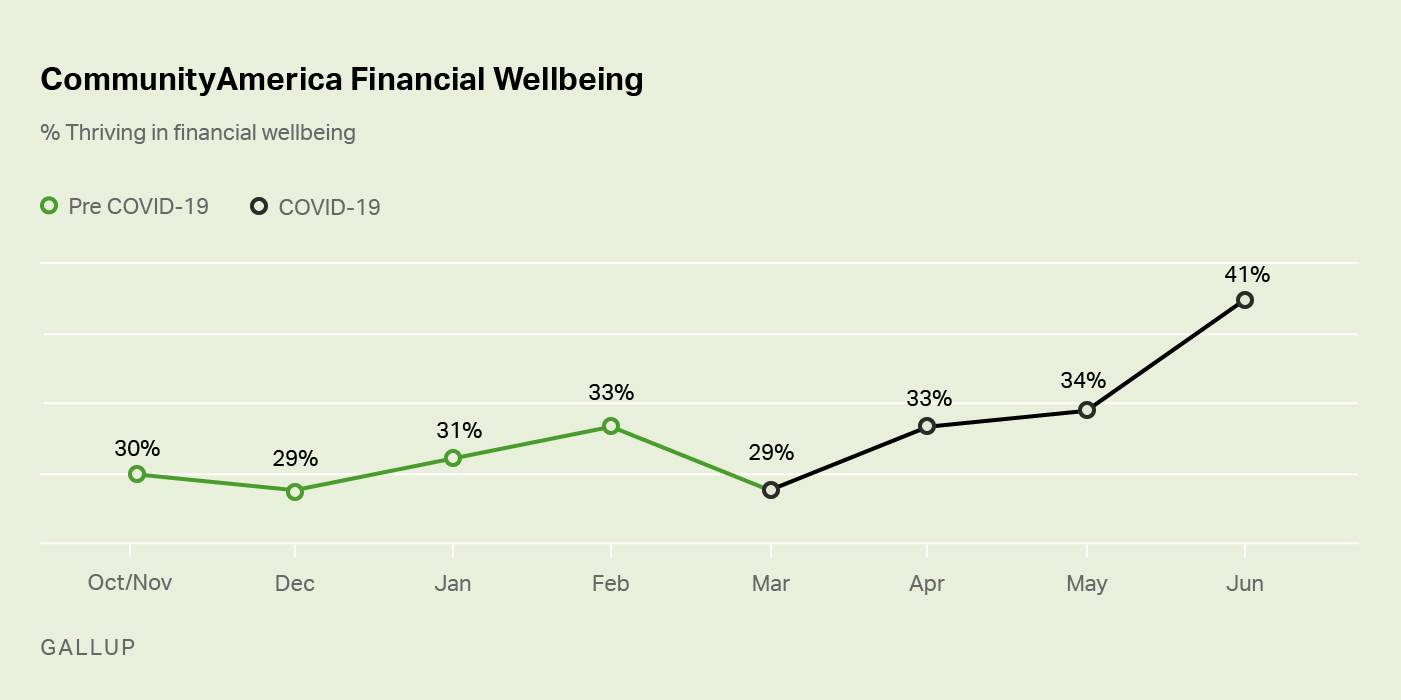

"When something happens," Saracini says, "we feel it before our members do." And CommunityAmerica's response was so well-calibrated that its members have a higher rate of thriving financial wellbeing now than they did before the outbreak of the coronavirus.

Line graph demonstrating CommunityAmerica's percent of members who are thriving in their financial wellbeing over time. The graph starts at 30% as measured in October/November of 2019 and it generally increased to 33% in February. Then, with the onset of the pandemic, the March reading is 29%, and then it rebounded to 33% again in April, up to 34% in May, with a high of 41% thriving in financial wellbeing in June.

In the following interview, Gallup Managing Partner Anson Vuong talks with Agee and Saracini about why tracking member engagement enables leaders to respond well to moments of truth. They also discuss how member engagement affects employees' attitudes toward members and members' demeanor toward employees, and why a credit union in Kansas City can be -- and probably should be -- a bellwether institution for the whole financial services industry.

Vuong: What's unique about your membership population, compared with other credit unions?

Saracini: We're right at the center of the country, but there aren't a lot of Fortune 500 companies in Kansas City, or a dominant industry, and it's a diversified community with a little bit of everyone here.

Our marketing is focused on five to 11 counties, the people who know us and trust us. But the area correlates highly with the United States for an outcome perspective, so I view us as a pretty good case study of what's going on in the country.

There's a lot to be learned in that.

Vuong: Has the pandemic changed your approach to your members' financial wellbeing?

Saracini: We've learned a lot from Gallup, that everyone's different, right? Feelings are facts, and the more we get perspective around those feelings, the better we can engage our members.

Since 2012, our strategy had been to increase members' engagement with the organization through the products and services they use with us.

In doing that, we thrived. But Covid-19 changed a lot of things for people.

It's a "moment of truth," a point where you can have the greatest impact, but you have to put yourself in the member's shoes and feel what they feel.

And when you really measure your members' feelings -- which are facts to them, like I said -- you realize how sensitive our members are to every interaction that we have with them. And it's not just about the services that they use and their participation with our products and our institution, it's a two-way engagement.

We need to engage with them for them to engage with us. Don't get me wrong, we're extremely consistent in the way we deliver services and that contributes to our success.

But the Gallup information made us much more sensitive to the things that they're sensitive to that we may not have understood even two years ago. That opportunity to listen to them is a resource.

Agee: It's in our DNA, that sensitivity to our members' needs, that drive to respond.

Having visibility to this member data has provided an opportunity to listen to our members and dive deeper into what they are feeling. Their feelings are really important and understanding them helps us help them.

What I think is really neat is that this member data has become a regular topic in a lot of our meetings. It's infiltrated how we do business every day.

Just hearing some of the people's stories through the verbatims -- members are sharing where they are at and what they believe they need. Some of the stories are incredibly compelling and we share member stories of how we were able to help a member through a hard time or achieve one of their financial goals during our sales meetings.

This drives our teams to want to do more.

Saracini: Engagement is part of our vocabulary, everyone knows what a moment of truth is.

But now we're able to anticipate some of them. For example, we know when the CARES Act runs out and unemployment insurance reverts back to the old numbers, our members are going to have a moment of truth.

Therefore, we're already planning ways to help them deal with that situation. Our engagement results tweaked our cadence to allow us to anticipate moments of truth and, in doing so, help them plan better.

When something happens, we feel it before our members do. So we've been able to answer their questions and deal with issues before they become a problem in many, many instances.

Vuong: Right, but your numbers were rising even before COVID-19. So I'm curious about the actions your organization took before the pandemic that have made a difference today.

Agee: Well, for a long time, we've provided financial coaching to our members.

That can include understanding your budget, how to save for things, understanding your financial credit score and how to improve it -- for example, when opening an account, we really have an in-depth conversation with the member before they ever even open it.

I think that sets a baseline comfort level with people as they come into our credit union. From the beginning, they know we're here to help them through whatever their financial situation is, we want to tailor our products to them and get them to the next phase of their financial goal.

Vuong: How has CommunityAmerica institutionalized those conversations across all the interactions? Training, tools, onboarding?

Agee: All of the above because you have to approach different things in different ways. For instance, we really encourage our teams to do a relationship review on a regular basis with members and use this as an opportunity to ask the member what else we can help with.

We discuss everything from their savings goals to how to build their credit to help with any future lending needs, future wealth planning, even what their plans are for paying for their children's college. Then we document the conversation in our CRM tool, so the member doesn't have to explain their story multiple times.

That way, if you walk into any branch or call the Contact Center, anyone you interact with can pick up exactly where the last person left off and know what's going on with that member.

When hiring, we look for people who feel comfortable having a conversation like that and we weave conducting those conversations into our employee onboarding through role-play.

"As we were going through the COVID-19 experience, our members indicated they were more comfortable talking to us than they've ever been before, and that seems pretty remarkable during such a vulnerable and challenging time."

Vuong: Tell me how member engagement plays into your hiring.

Agee: I know it sounds funny, but we don't necessarily always have to hire someone with banking industry knowledge on the front line.

We often focus more on hiring people that are approachable and comfortable having a compassionate conversation.

Vuong: No, that's really smart. Being able to talk to people is a talent and hiring them is a sophisticated strategy.

Agee: Yeah, there's probably a better chance that someone like that will interact well with our members, just because they know how to make our members feel comfortable.

Actually, our score for making our members feel comfortable is consistently good, but we hit all-time highs in the months of March and April.

So, as we were going through the COVID-19 experience, our members indicated they were more comfortable talking to us than they've ever been before, and that seems pretty remarkable during such a vulnerable and challenging time.

To me, that speaks volumes about the groundwork we've laid.

Saracini: Well, it goes back to your book, It's the Manager, right?

You guys talk about the importance of good management. And Rick Schier has been providing consistently good management for over 16 years and his direct reports do too.

That's made it easier for us to engage members. Quite honestly, I think if you looked at the correlation between our scores and Missy's and Rick's parts in the process, their management is probably the single most correlated factor in the outcomes.

Vuong: But the pandemic threw everyone into a new paradigm. What was your response for your members?

Saracini: The first thing we did was set up two member-assistance teams that met biweekly at first, and now we're meeting weekly.

One was a readiness task force concerned with our employees' and members' physical wellbeing. The other was a member-assistance team that focused on products and services for our members.

The notion of a moment of truth helped us there because we saw it coming. We knew what members would be going through -- fear. We met that anxiety with action, and I think that helped our engagement numbers.

The CARES Act lowered the anxiety even more, so the combination of those two events probably contributed to the outcomes you're seeing in our surveys. But unemployment benefits are going to run out on July 31 unless they're extended. Maybe they will, maybe they won't. So we already have products and services teed up for August 1 in case there is additional hardship.

We estimate local unemployment will be between 10% and 12%, and we have a pretty good idea what that's going to look like from a credit perspective. Very similar to2008. You know, a lot of people will tell you this isn't 2008. Well, it isn't, but we're getting ready to enter the phase of this pandemic that most resembles 2008.

"When something happens we feel it before our members do. So we've been able to answer their questions and deal with issues before they become a problem in many, many instances."

We still have products on the shelf from the Great Recession that helped our members through that crisis, and we'll use them as needed. But our strategic plan for next year is still to increase the percentage of our members with thriving financial wellbeing.

Agee: And we're fortunate that our technology was positioned pretty well on the branch side.

For instance, when we had to close the lobbies, we could still transact and help the member through ITMs [interactive teller machines] outside the branch. I think our members appreciated that we didn't say, "No, we can't do that," or, "We're so sorry, check back with us when this is all over."

Even if members needed to come in, we opened by appointment, so their level of service never changed. And we did some outreach calls to our members who had indicated on the Gallup survey that COVID-19 had impacted their lives greatly.

That was an idea we got from collaborating in the consortium and it had such an impact. We just called and said, "Hey, how are you doing? What can we help you with? Are you getting through this okay?" We didn't have an agenda. We weren't calling to talk about a promotion. It was truthfully about meeting their needs.

And you wouldn't believe how well-received those phone calls were. We also reallocated people to support whatever channel had the most volume. The day the first stimulus checks came in, we experienced record call volume and it was okay -- we had ramped up our call center with branch people.

We quickly cross-trained, and they were on the phones taking calls just like a call center agent. That went over really, really well.

Vuong: You were available and prepared.

Saracini: Yes. We saw this coming, so everyone was teed up and ready to go.

Of course, it's too early to do a postmortem on our COVID-19 response, we're not even close. I don't even know what inning we're in. There will be a lot of lessons to be learned through this process.

But the cultural lesson to learn is that engagement is in our DNA. Our brand is our people and how we engage with our members, and that's the strength of our business model. Because, by itself, data is just data. It's what you do with the data that matters.

You have to consolidate it with talented people, look for cross-functional opportunities, and use it to make business decisions.

We're always looking to make the right business decision for the organization, keeping in mind our members are our only entity.

The thing about credit unions is they exist to help people. The purpose is always to give back, right? It has to be, because there's no other reason to do what we do.

We want to make every single business decision with the mindset of we're important to Kansas City and the people who live in Kansas City.

Our members need us, as the data shows, and we'll be here for them.

Get the support you need to support your members:

- Learn more about Callahan & Associates and Gallup's collaborative initiative to drive credit union member engagement.

- Explore other resources for leading through COVID-19 disruption.

- Use Gallup's financial services analytics and advice to navigate evolving customer expectations and behaviors.