The following is an excerpt from our paper Creating More Digital-Forward Customers, written to help financial institutions improve digital adoption among customers.

Financial services organizations are investing more in IT than ever before -- often exceeding 10% of their revenues -- with a heavy focus on digital transformation. What organizations often lack, however, is a holistic strategy to shift customer and employee behavior to propel long-term adoption of digital channels.

Many of the banks, credit unions and wealth management organizations Gallup works with are focused on building platforms, digital capabilities and features. However, despite similar offerings, there is massive variation in the use of these platforms and features from organization to organization. Gallup finds that some banks' customer use of digital features and services is 20 times that of similar banks, indicating that a digital channel's existence doesn't guarantee customers will use it.

The cost of this missed opportunity is massive. For larger institutions, Gallup calculates that the lost opportunity exceeds $5 billion in customer value and cost savings.

In fact, it is not uncommon for banks to win national awards for mobile apps and experiences, yet have very low adoption rates. In other words, availability of quality digital platforms and features does not equal adoption.

The cost of this missed opportunity is massive. For larger institutions, Gallup calculates that the lost opportunity exceeds $5 billion in customer value and cost savings. For smaller institutions -- small regional banks and credit unions, for example -- the lost opportunity likely exceeds $100 million. To capture this opportunity, banks must create more digital-forward customers -- customers who use digital channels for basic and complex banking actions.

Traditional Approach: Go Direct

For organizations to facilitate digital adoption, they must make their customers aware of what they can do via digital channels and educate them on how to do it. Gallup's Annual Financial Services Study shows significant variation among banks in the level of customer awareness and education.

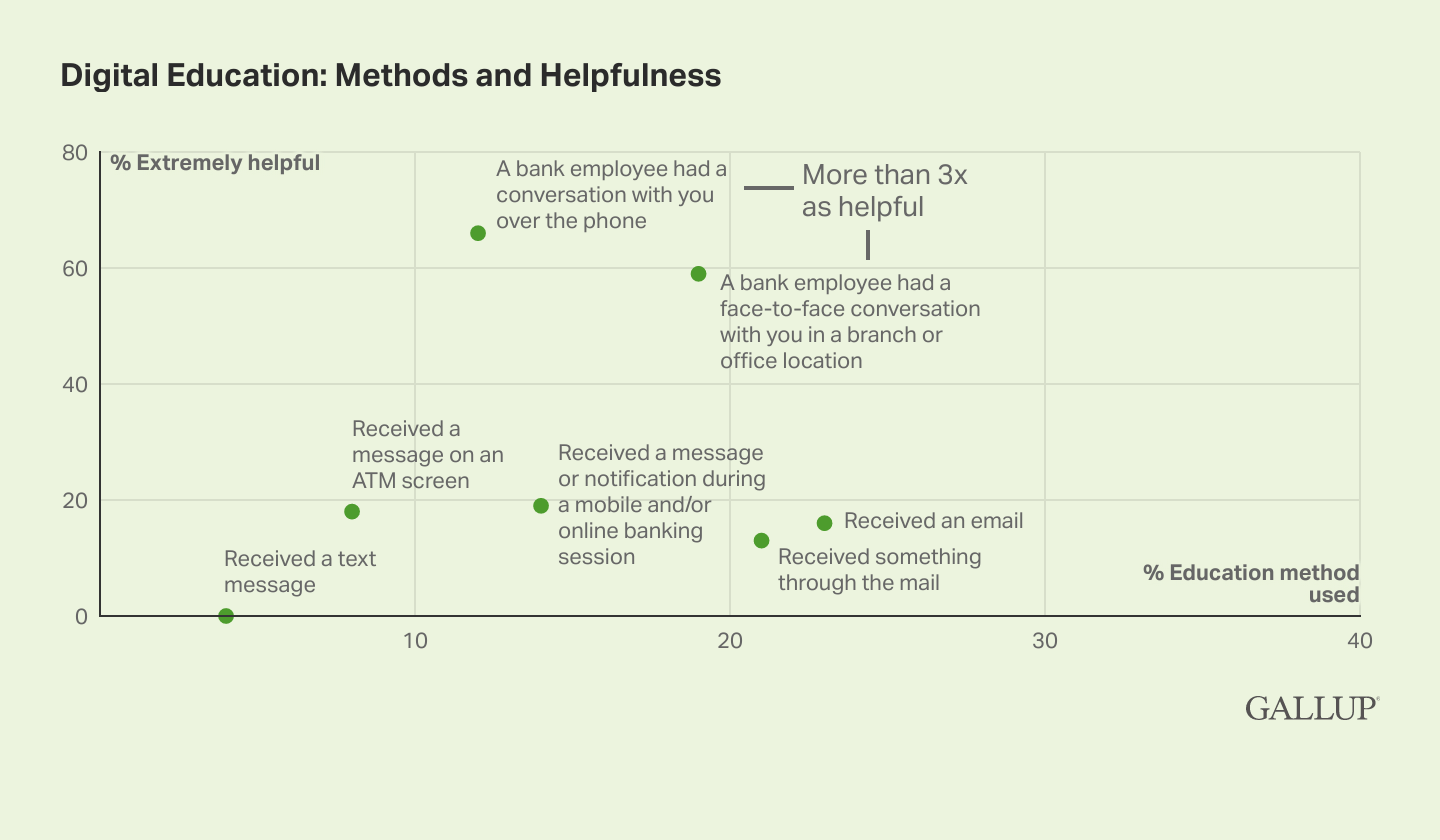

Banks rely most heavily on direct outreach methods -- particularly email and mail -- to bring awareness and education to their customers. However, fewer than one in five customers find these methods to be helpful.

Customers deem human interactions to be more than three times as helpful.

Scatter plot custom graphic. Banks rely most heavily on direct outreach methods -- particularly email and mail -- to bring awareness and education to their customers. However, fewer than one in five customers find these methods to be helpful. Customers deem human interactions to be more than three times as helpful.

Intentional development of a digital culture among human channels is the predominant factor in achieving digital adoption. Simply put: Humans are necessary for successfully driving customers' digital adoption.

However, the investment in the necessary time, energy and resources to enable human channels to help facilitate that change lags behind spending on digital features and platforms. This underinvestment creates a problematic duality: great digital tools but low digital adoption. The gap costs banks billions in real costs and missed customer value.

It is not a surprise that this gap exists: Advancing digital capabilities is far easier than advancing people and culture. Changing local attitudes and service behaviors takes intentionality -- it must be done by design, not by default. Specifically, banks need to invest in building an effective digital culture and enablement infrastructure to complement their digital features and platforms. One is not optimized without the other.

The road to creating more digital-forward customers starts with a human-driven strategy based on governance, change leadership, digital enablement, and analytics and impact. Banks that can most effectively manage these four pillars to blend technology and touch will be the digital leaders.