The following is an excerpt from our paper Creating More Digital-Forward Customers, written to help financial institutions improve digital adoption among customers.

A bank customer's TrueDigital Quotient is the measure of their success in completing the desired action through digital means. Knowing this number for each customer is essential to being able to meet their needs.

But that's just part of the picture when it comes to digital adoption. Your customers -- even those with similar TrueDigital Quotients -- aren't all the same. Their individual behaviors, particularly how they engage with your digital offerings and tools, can be observed and used to sort them into groups or digital segments.

It's in knowing both a customer's TrueDigital Quotient and their digital segment that financial institutions are able to elevate the service provided and meet each customer exactly where they are to help enable digital adoption.

The 3 Broad Digital Segments

There is significant variation in the types of actions and transactions customer groups carry out via digital channels. Some customers only use online or mobile banking for basic actions, such as checking an account balance, making a mobile check deposit or transferring money, but they generally prefer to interact with their bank via human channels. Gallup calls these customers, along with customers who never interact digitally, digital laggards.

On the other end of the spectrum, digital-forward customers turn to digital channels as their first choice for all of their basic banking and the majority of their complex banking, such as opening or closing an account, applying for a loan, or resolving a problem or issue. Digital-forward customers typically only use human channels if they can't complete their intended action in a digital channel.

The remaining customers in the middle of the spectrum tend to use digital for many of their basic and complex banking needs but tend to turn to human channels as the complexity of their needs or actions increases.

- Digital laggards: Customers who never interact digitally or only use digital occasionally for basic banking and prefer human channels for most actions.

- Digital-forward customers: Those who use digital channels for basic and complex actions and rarely use human channels.

- Middle customers: Those who use a mix of digital and human channels for their basic and complex actions.

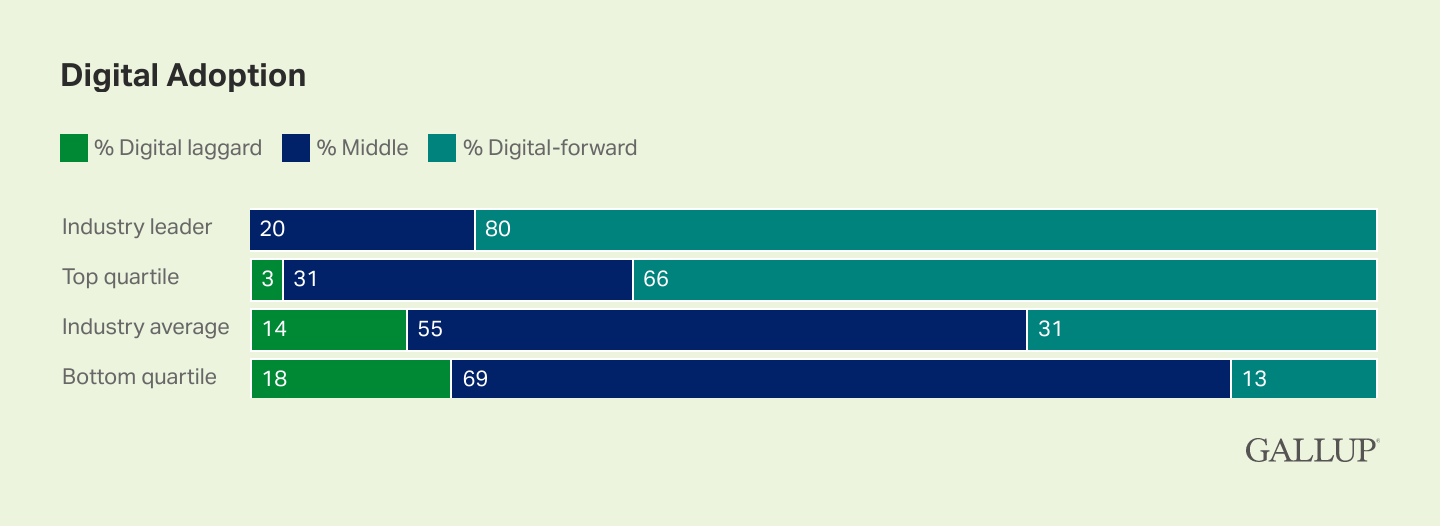

Two-thirds of customers at banks in the top quartile of digital adoption are digital-forward -- nearly none are digital laggards. Banks in the bottom quartile of digital adoption, however, average 13% digital-forward customers and 18% digital laggards. Across the industry, the typical bank or credit union has a significant opportunity to increase digital use with seven in 10 customers.

Custom graphic. Among industry leaders, 80% of customers are digital forward. Among top-quartile financial institutions, 66% are digital forward. Among average institutions, 31% are digital forward, and among bottom-quartile financial institutions, 13% are digital forward.

Not every digital-forward, middle or laggard customer looks the same. Gallup partners with its clients to break down those three broad categories into more nuanced customer segments to help leaders prioritize their focus and actions.

Banks should know what percentage of their customers are in each segment and focus on eliminating digital laggards and shifting customers' behavior toward greater digital utilization.

So how should banks go about creating more digital-forward customers? First, let's discuss the challenges that leaders and banks must overcome.

Common Challenges That Prevent Human Channels From Optimizing Digital Adoption

Gallup's work with banking clients has uncovered six areas in which banks struggle to accelerate digital adoption through human channels: culture, change leadership, infrastructure, analytics, decision-making and journeys/proficiency.

1. Culture

- Common challenges: underuse of employees to drive digital adoption; lack of alignment among leaders and business units

- Insights: human ("touch") channels are three times more effective in driving digital awareness than direct; four in 10 employees know what their company stands for and what makes the brand different from competitors

2. Change leadership

- Common challenges: significant variation in digital adoption between markets/key segments; expectations, scorecards and incentives don't support digital adoption

- Insights: focus should be on how there's often a 20% to 30% difference in digitally active customers between markets

3. Infrastructure

- Common challenges: reliably creating core digital and feature adoption at scale; lack of a digital enablement organization to connect digital with lines of business and divisions

- Insights: less than half of banking customers say their bank made them aware of the digital tools they could use; only 39% said their bank communicated how to use the tools

4. Analytics

- Common challenges: knowing which customers can and will adopt digital offerings; quantifying the value of a digitally engaged customer (cost and lifetime value)

- Insights: top banks in digital adoption have more than twice the number of digital-forward customers than average banks do

5. Decision-making

- Common challenges: unclear decision-making authority; competing priorities along with misalignment between digital and other lines of business

- Insights: six in 10 employees say they don't have the materials and equipment they need to do their job right (e.g., decision-making authority, access to knowledge or resources, expertise)

6. Journeys/Proficiency

- Common challenges: focus on attempts but not proficiency; inconsistent experience between channels

- Insights: customers complete three in four complex actions through human channels; only 17% of banking customers are extremely satisfied with all the channels they use

Based on our client engagements in financial services, Gallup recommends that banks create their Digital Culture and Enablement Infrastructure by implementing four pillars to accelerate digital adoption through human channels. Gallup helps banks operationalize each pillar and optimize the collaboration within and across pillars to achieve real scale and impact:

- governance

- change leadership and execution

- digital enablement

- analytics and impact

Learn more about the four pillars and how to navigate common challenges to drive digital adoption:

- Download our recommendations in Creating More Digital-Forward Customers.

- Contact a Gallup expert today.