Story Highlights

- Half of Americans have substantial financial anxiety

- Worry stable this year, though down from recession

- Lacking money for retirement remains top financial worry

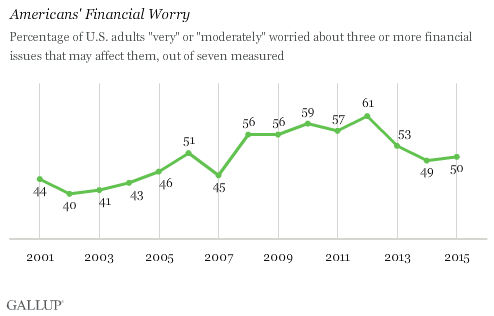

PRINCETON, N.J. -- Gallup's Financial Worry metric, which tracks the percentage of Americans worried about multiple common financial challenges, is steady this year at 50%, similar to 49% in 2014. While the metric is down from the 56%-to-61% range seen during the economically challenged period from 2008 through 2012, it remains higher than it was previously.

This metric reflects the percentage of Americans who are moderately to highly worried about three or more financial issues out of the seven that Gallup has tracked annually since 2001 as part of its annual Economy and Personal Finance survey. This year's survey was conducted April 9-12.

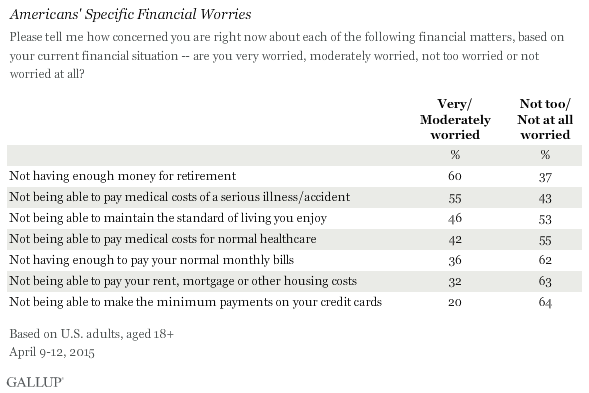

A variety of financial issues are asked about, ranging from not having enough money for retirement -- the most common worry, which 60% of Americans say they are "very" or "moderately" worried about -- to not being able to make the minimum payment on credit cards, at 20%. Not being able to afford medical costs associated with a serious illness or accident also ranks high, at 55%, while slightly less than half worry about maintaining their standard of living or paying for normal healthcare. Fewer than four in 10 U.S. adults worry about not having enough to pay their normal monthly bills, or being able to pay their rent or mortgage.

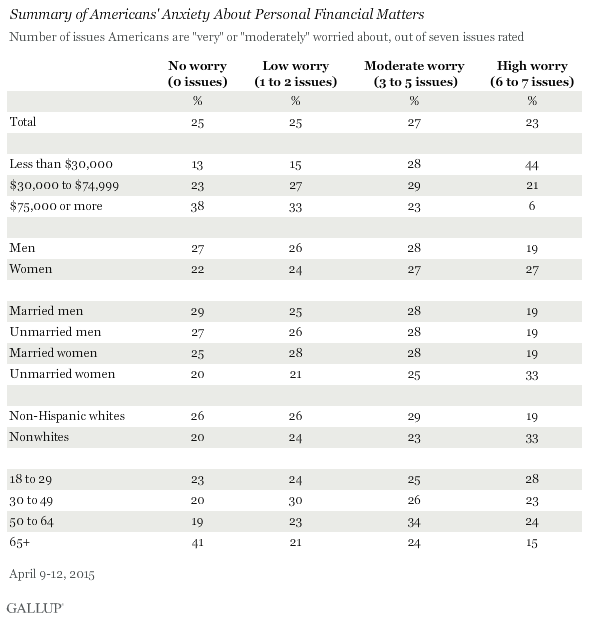

Americans break into four closely sized groups according to their level of financial worry. Roughly one in four are high worriers, worried about six or seven of the seven financial concerns. Another 27% are worried about three to five of these issues, while 25% are worried about one or two and the remaining quarter are worried about none.

Adults in households earning less than $30,000 a year are fraught with financial anxiety, with 44% worried about six or seven of the seven issues, and a combined 72% worried about three or more. The proportion of heavy worriers drops sharply among higher income groups, amounting to just 6% of those households earning $75,000 or more. Accordingly, two major U.S. subgroups associated with lower income -- women and nonwhites -- worry significantly more than their counterparts, men and non-Hispanic whites.

In part because of their fairly high income, but also because their stage in life corresponds with lower household expenses and their nearly universal access to government healthcare such as Medicare, seniors are significantly less likely to harbor financial anxiety than younger Americans.

An additional item asked as part of the list each year since 2007, but not included in the long-term worry index, is not having enough money to pay college expenses for one's children. This is a relatively low-level concern among all Americans, with 36% saying they are very or moderately worried about it. However, a separate Gallup analysis found that concern about saving for college rises to 73% when focusing on parents of one or more children younger than age 18.

Bottom Line

In January, Gallup found Americans relatively upbeat about their finances at a time when gas prices were tumbling. The 47% then saying they were financially "better off than a year ago" approached the highest levels recorded over the past 40 years, and on par with early 2007. However, Americans' current levels of worry about seven fundamental indicators of financial health suggest they have still not fully recovered from the recession. While they are less worried about everyday financial matters than they were during and immediately after the 2007-2009 recession, Americans remain more worried than they were in the years preceding it.

It's a "good news, bad news" story likely resulting from the gap that still exists between Americans' financial outlook and their reality. A separate finding out of the April poll puts public optimism about their finances at an 11-year high, with 52% saying their financial situation as a whole is getting better. At the same time, Americans' rating of their current finances remains subdued. The 46% describing their finances as "excellent" or "good" falls below the 51%-to-57% range of a decade earlier.

Survey Methods

Results for this Gallup poll are based on telephone interviews conducted April 9-12, 2015, with a random sample of 1,015 adults, aged 18 and older, living in all 50 U.S. states and the District of Columbia. For results based on the total sample of national adults, the margin of sampling error is ±4 percentage points at the 95% confidence level. All reported margins of sampling error include computed design effects for weighting.

Each sample of national adults includes a minimum quota of 50% cellphone respondents and 50% landline respondents, with additional minimum quotas by time zone within region. Landline and cellular telephone numbers are selected using random-digit-dial methods.

View complete question responses and trends.

Learn more about how Gallup Poll Social Series works.