Story Highlights

- The most successful mergers and acquisitions focus on cost reduction and revenue growth

- The better your customer interactions, the more organic growth you will see

- Senior leaders need to understand customers' expectations before the M&A

In a typical merger and acquisition (M&A) setting, B2B senior leaders handle cost-cutting and account leaders are responsible for creating organic growth.

The best senior leaders seek organic growth by architecting the new organization from the ground up. They do this by conducting business appraisals, known as due diligence, from the perspective of the local account team.

Only 29% of B2B customers are fully engaged, and the M&A integration process often distracts B2B organizations from customers at a time when they should focus on customers the most.

Understanding the Roles of Classical Economics and Behavioral Economics

The best kind of M&A is one where the combination of cost reduction and revenue generation delivers a better outcome than either one on its own.

However, most senior leaders focus solely on the immediacy of cost-cutting. They don't realize that they could be generating even more revenue by using organic growth strategies at the beginning of the M&A process.

| Cost-Cutting Strategies | Organic-Growth Strategies | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Headcount reductions | Expanded expertise and capabilities | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Overhead consolidation | Selling complementary products/services | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Production/distribution redundancies | Access to new markets and customers | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Purchasing power | New talent pools | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gallup | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

The problem is this: senior leaders look at both strategies from the same "corporate office" vantage point -- a fundamentally flawed approach.

Cost-cutting is an organizational-level function that comes from the top, down. Senior leaders need to look at organic growth as a local-level function led by account leadership -- a bottom-up approach.

Put simply, classical economics (cost-cutting) streamlines the business, while behavioral economics creates organic growth.

The best senior leaders design the new, post-M&A organization for organic growth from the ground up.

What Should Your Customer Culture Look Like Post-M&A?

Organic growth occurs at the local level, between each account team and their interactions with their customer(s).

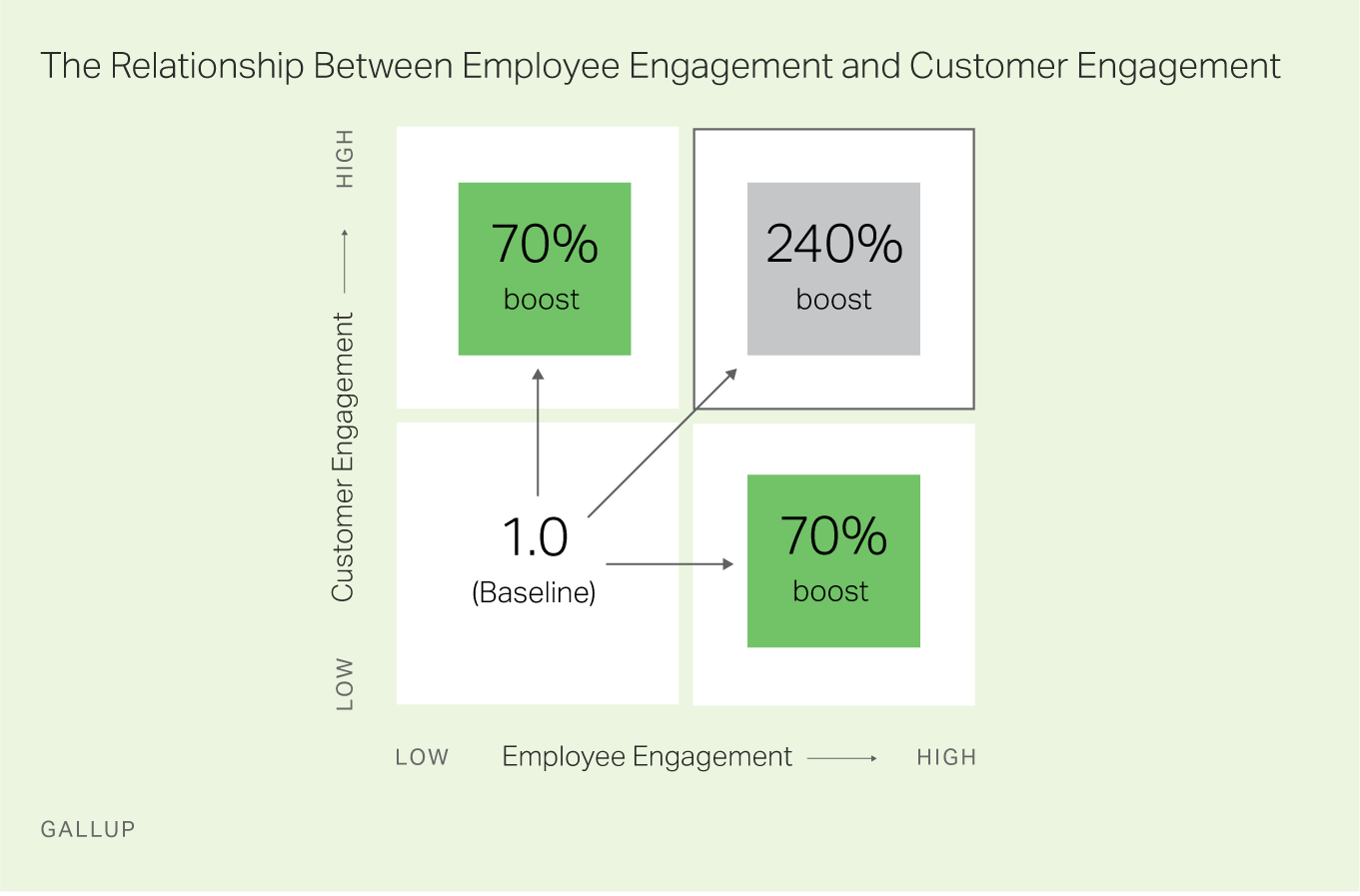

Gallup studies show that an organization can amplify financial performance when local teams bring consistency and quality to their customer interactions.

After the M&A dust settles, leaders should ask the question: How differently (or similarly) and how effectively do local account teams operate to improve customer outcomes?

These local interactions create the account's customer culture -- and for most B2B organizations, there are as many customer cultures as there are customers.

And so, the best senior leaders define their ideal customer culture by understanding how the most successful account teams operate.

They understand there is no such thing as cultural integration: either one culture eats the other, or a new culture is born -- there is no middle.

Then, they seek to ensure all the organizational systems, policies, procedures, recognition, evaluations, etc., position local teams to succeed.

To do this well, senior leaders need to understand the customers' expectations up front by conducting customer appraisals -- this informs how to create the new organizational structure.

How to Create New Business Opportunities Within Your Existing Customer Relationships

The right customer assessment not only reveals the strength of existing customer relationships, but also how primed they are for new business activity.

This assessment should be standard practice for every M&A.

Great customer relationships exist when customers are engaged and look to grow with you.

The idea that a strong customer relationship equates to a growing customer relationship is simply not true. Don't mistake loyalty for growth.

Gallup studies show that customers indeed need to be engaged -- or emotionally attached to your company -- to foster the right environment for growth.

Customers who are fully engaged represent an average 27% premium in account retention.

But engaged customers need local account teams to proactively partner with them to find those new business opportunities.

When you begin bringing your customers new ideas, you transition from being a service provider to a trusted partner. Customers who view you as a partner are likely to have a growing relationship.

For example, there is a meaningful difference between answers to the statements: "[Company] regularly keeps in touch with you," and, "[Company] proactively discusses your future needs." Agreeing to the former may signify an engaged customer relationship, but agreeing to the latter signifies deepening one.

Thereby, any customer appraisal should involve not just finding out how well the customer is being serviced, but also an attempt to discover adjacent growth opportunities.

The best senior leaders will ask, "How well is my company positioned to capture those opportunities?" and, "What is the clear path to success for local account teams to do so?"

The key difference with customer appraisals, in contrast with financial or operational assessments, is that the customer intelligence gleaned is shared with local account leaders and teams, rather than just senior leaders.

Collecting customer feedback is one thing, and usually easy, but truly knowing how your local account teams must interact with your organization's customers in a forward-looking, ongoing way is the key to seeing long-sought-after growth.

To oversee a successful M&A, senior leaders should:

- plan for organic growth as well as cost savings before the M&A

-

design the new, post-M&A organization from the ground up, using the principles of behavioral economics

-

define the customer culture that will promote loyalty and growth by first understanding how your most successful account teams behave and operate

-

assess all pieces of organizational change management (systems, policies, procedures, recognition, evaluations, etc.) by how they promote or inhibit those local behaviors

Learn more about how Gallup can help your organization navigate M&As equipped with proven best practices from successful leaders:

- Register for our free webinar to hear real-world examples of successful B2B mergers and acquisitions.

- Discover how Gallup helps leaders see dramatic growth and improve consumer confidence with analytics-based decision-making.

- Download our free guide to sustainable business growth through customer engagement.

- Watch our Best of 2017 webinar to get even more expert insights that can help you grow your business organically.