Story Highlights

- Few Americans are very satisfied with U.S. healthcare quality

- Healthcare leaders can't afford a "business as usual" strategy

- Focus your financial recovery strategy on five key areas

The U.S. healthcare system is in a state of emergency.

Gallup 2020 data show that only 19% of Americans are "very satisfied" with the quality of medical care in the U.S., a figure that has remained largely constant over the past two decades.

Line chart. In 2020, 19% of Americans are very satisfied with the quality of medical care in the U.S. This percentage has remained stable throughout the past two decades.

And compared with other developed nations, the U.S. ranks highest on chronic disease burden, lowest on access to care and lowest on health system quality -- despite annual national health spending of $3.6 trillion ($11,172 per person).

These problems make post-COVID recovery strategies even more critical. To recover financially, healthcare leaders must unite, collaborate with leaders from other industries and reevaluate traditional practices.

There is no doubt that healthcare leaders have responded to the COVID-19 pandemic heroically, with many using this painful opportunity to embrace new learning and prepare for the next inevitable crisis.

For example, COVID-19 has accelerated much-needed change, such as the digital and technological transformation that many healthcare organizations were trying to actualize before the crisis.

But healthcare leaders still find themselves in a precarious position due to considerable revenue loss. The American Hospital Association predicts that the financial strain on hospitals and health systems due to lower patient volumes "will continue through at least the end of 2020" -- a likely total loss of $323 billion in 2020.

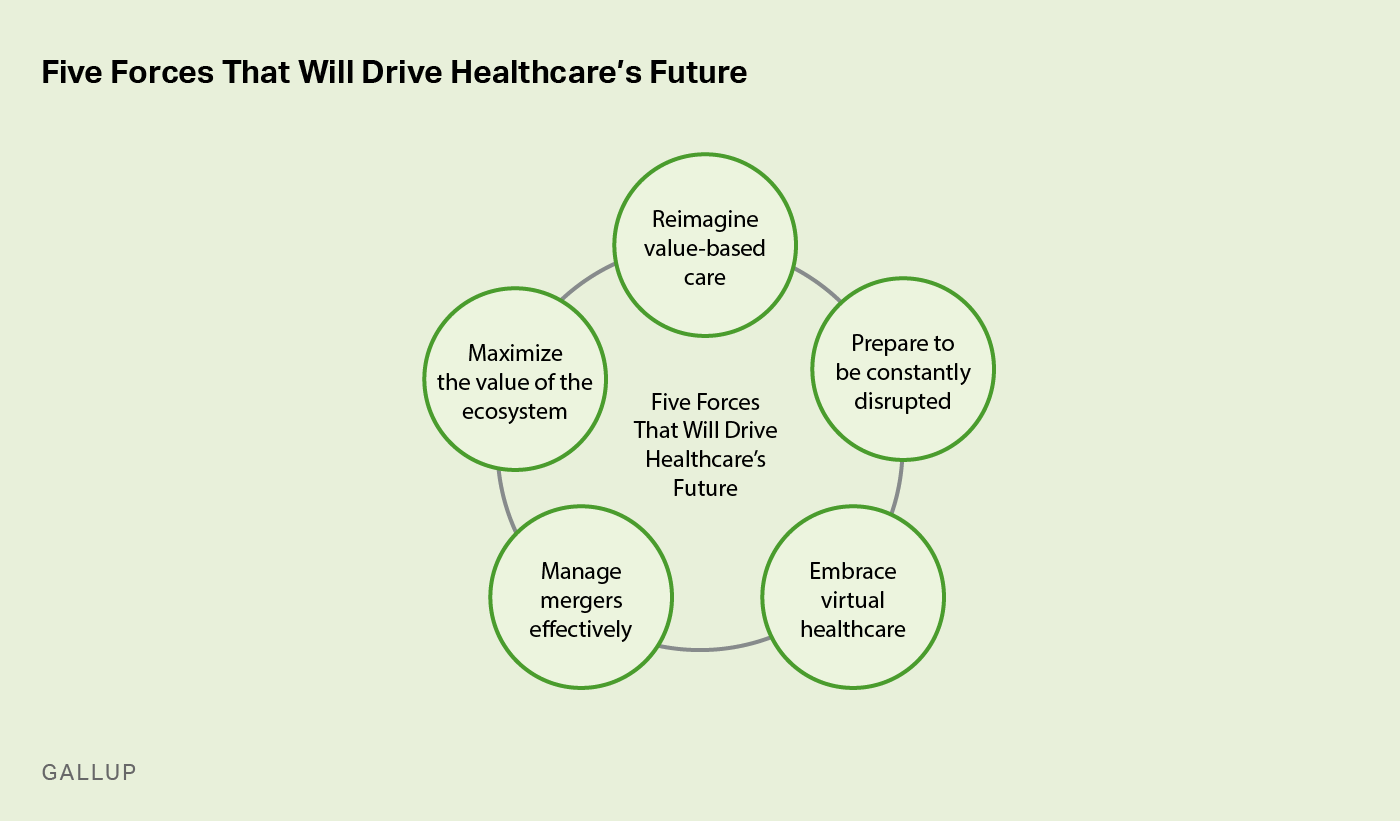

Gallup has conducted research in the field of healthcare for decades, including just before and during the pandemic. A recent review of this research uncovered five forces that are paramount for any healthcare organization's survival -- through the current crisis and beyond.

Custom graphic. The five forces that are paramount for healthcare organizations' survival are: Reimagine value-based care; Prepare to be constantly disrupted; Embrace virtual healthcare; Manage mergers effectively; and Maximize the value of the ecosystem.

Reimagine value-based care.

Accountable care organizations (ACOs) have invested significantly in value-based care in recent years. It's important to protect and even grow participation in this vital program. But healthcare organizations committed to value-based care must know that achieving key results in the future will require a shift away from conventional thinking and legacy ways of working.

To start, health systems need to enhance payer-provider collaboration and fine-tune value-based measures. But to optimize value-based care, hospitals also need to sharpen their efforts in building organizational agility -- in everything from processes to shared mindsets.

Value-based care can no longer be separated from the quadruple aim; rather, it should drive patient experiences, population health, cost reduction and caring for the caregiver.

Leaders' aim to recuperate lost revenues might create an excessive focus on cost-cutting. This is bound to cause serious disruptions to employees and patients. The best hospitals will continue to prioritize an integrated strategy that promotes the quadruple aim through constant review and improvement of the patient and employee experiences.

Prepare to be constantly disrupted.

COVID-19 has accelerated the healthcare industry's erstwhile sluggish digital transformation journey.

Even before the pandemic, technological and macroeconomic factors were steadily reshaping healthcare, from heightened venture capital interest in healthcare tech to organizations such as Amazon acquiring a supply license for pharmaceutical drugs.

Post-pandemic, the evolution of healthcare delivery will increase -- far beyond the increase in virtual healthcare. Consider, for example, distributed healthcare -- urgent care clinics, free-standing emergency setups, retail clinics. Research has shown a higher return on invested capital (ROIC) for these alternatives compared with conventional hospital systems.

But to effectively deal with disruption and stay on the cutting edge of innovation, healthcare must also invest in top talent. Recent Novartis research showed that 83% of technology professionals would consider working in the healthcare and pharmaceutical industries, with 72% more likely to consider it compared with six months ago. As these industries evolve -- both as a consequence of COVID-19 and other industry forces -- leaders need top talent to effectively integrate new delivery models and capture new market opportunities. The trouble is, in a dynamic time when talent has never been more crucial, retaining and acquiring talent that drives innovation is arguably more challenging than ever before. To secure their organization's future, leaders need a proven, research-based talent attraction strategy.

But acquiring the talent to accelerate innovation is just the beginning. Retaining and developing talent are equally important to performance and patient outcomes. An estimated 1.4 million health jobs were lost in March and April -- and there is likely to be further turnover due to the pandemic, especially among RNs and physicians.

Healthcare providers need greater sophistication in management and leadership development for two reasons:

- Managers are central to team engagement and retention, so retaining and developing great managers supports exceptional workplace performance.

- With physicians playing a more central leadership and business role, physicians and nursing leaders must enhance their capacity to thrive in uncertainty.

Embrace virtual healthcare.

It is not surprising that the pandemic has ramped up virtual healthcare. The Centers for Medicare & Medicaid Services (CMS) loosened telehealth and HIPAA guidelines for Medicare, and commercial payers are following suit. The president recently issued an executive order to permanently expand some telehealth services in rural areas beyond the COVID-19 pandemic.

Gallup recently published our perspective on virtual healthcare in American Journal of Managed Care. In a 2019 survey, we had found that only 14% of Americans said they had used telemedicine in the past year, and only 17% said they anticipated using it in 2020. But in March 2020, we found that 34% of Americans reported having used telemedicine, and nearly half (46%) said they are likely to use it in the future -- almost three times greater than approximately six months prior. And while telehealth usage rates may have declined from their peaks in the early months of the pandemic as many providers hastened back to in-person visits, public desire for telehealth has only continued to grow, with 50% saying they are likely to use it in the future as of September.

The best hospitals will continue to prioritize an integrated strategy that promotes the quadruple aim through constant review and improvement of the patient and employee experiences.

Because patient needs and expectations will evolve continuously, hospitals need to constantly track patient insights across the continuum of care -- including the virtual space. Despite the current interest in telehealth, the future of healthcare delivery is likely to be omnichannel -- combining telemedicine, retail clinics, on-demand care and more. Integrating these channels effectively will also require a significant change in leadership, as well as a more robust change management process to ensure that new technology is utilized optimally.

Manage mergers effectively.

Hospital M&A activity was at an all-time high in the years leading up to the pandemic. In 2019, nearly 100 healthcare mergers were announced -- but the COVID-19 crisis has put pressure on some of these deals. Post-pandemic, as the healthcare industry comes to terms with sustained losses, there might also be more significant pressure to consolidate.

McKinsey research conducted before the pandemic showed that healthcare systems with more than 50% of the market share had 30% higher margins than those with less than 25% market share. And operating margins of systems that are investing in growth in distributed care settings outperform all other inorganic/M&A-type activity -- making them immediately more attractive. The hundred-odd mergers in 2019 were also unique because acquirers were not focused on obtaining "more of the same"; rather, they were looking for ways to expand their portfolios, market opportunities and service offerings. In a post-COVID world, maximizing merger outcomes will require heightened innovation, with leaders reevaluating legacy merger management tactics in pursuit of an approach that will drive outcomes in this new climate.

For example, leaders navigating M&A must relentlessly develop and engage talented RNs, physicians, physician leaders and nursing managers. Gallup research shows that during a merger, managers play a vital role -- but only 35% in the U.S. are engaged.

M&A outcomes aren't the only thing on the line: Engagement can mean the difference between retaining your top talent or losing it overnight in these highly unpredictable times. During post-merger integration, to optimize performance and quality of care, leaders must prioritize the engagement of healthcare managers, physician leaders and nursing managers.

Maximize the value of the ecosystem.

The healthcare system today is a complex web of interconnected stakeholders. And the ecosystem is expanding -- beyond the traditional players such as payers, providers, pharma and medical devices.

In the post-pandemic world, the ecosystem might look very different. For instance, service vendors have been experiencing more significant profit growth -- greater than 10% compared with other more traditional players. These service vendors, which include clinical services and financial services, are primarily growing because of advancements in analytics, big data and digital transformation.

Proactive collaboration among players in this new ecosystem will be critical for COVID-19 recovery. Further, real transformation in healthcare requires more significant linkages and synergy among these diverse players. Leaders in this ecosystem are all committed to the same goal -- transforming healthcare and improving accessibility -- yet make unique contributions and apply complementary strategies.

Some partnerships are more important to get right, such as payer and provider synergy. Integrated healthcare delivery systems are uniquely positioned to maximize synergy between insurance and healthcare provision. Leveraging big data across multiple healthcare touchpoints is another key opportunity.

More than ever, the speed of collaboration is vital -- for instance, PPE manufacturers need to proactively coordinate with hospitals to develop and deploy critical resources. The most urgent, of course, is vaccine development and advances in diagnostic testing -- not only for COVID-19 but for future outbreaks as well. These "high mission" initiatives require extreme levels of agile collaboration among diverse healthcare industry players.

An Evolution -- Not a Revolution

As a direct economic result of the pandemic, millions of Americans have lost their jobs -- and in turn, health insurance benefits.

For everyone, the journey toward recovery will be arduous and protracted.

Life ratings plummeted to a 12-year low in April 2020, according to Gallup Panel data, with Americans reporting severe stress and financial worry. And even before the pandemic, a West Health-Gallup survey in early 2019 revealed that 45% of Americans feared a major health event would leave them bankrupt.

The much-touted digital and technological advances in healthcare are necessary but cannot singlehandedly solve these endemic issues in the short term. Rather, progress requires intense collaboration among leaders from government agencies, private enterprises and research institutes. These leaders must engage the collective talent, imagination and intellect of every employee and player in the industry.

Maximizing the collective impact of the combined system will require a unified approach aimed at improving the quality of care and reducing costs. Beyond that, leaders across the industry must focus on enhancing holistic patient wellbeing -- going beyond physical health to improve financial, emotional and societal wellness.

Leaders need to set their gaze on collaboration and cross-sectoral synergy. Indeed, healthcare leaders of the future must be boundaryless and acknowledge and appreciate the interdependence of all healthcare players. The future of healthcare in the U.S. depends on it.

Secure the financial future of your healthcare organization:

- Partner with us to sharpen your recovery strategy.

- Develop leaders who succeed amid disruption.

- Download our report Employee Burnout: Causes and Cures.