Story Highlights

- Credit unions are better at supporting members' feelings of wellbeing

- Banks should seek to understand their customers' definitions of wellbeing

- Ease of managing finances is the largest gap felt between members and customers

It seems like every financial institution is professing to improve its customers' financial wellbeing.

The value proposition is straightforward, but success is not.

Only 14.5% of customers strongly agree their institution looks out for their financial wellbeing. To improve this, bankers need to understand that their customers' financial needs are highly personal, emotionally charged and contextual.

Creating the perception of improved financial wellbeing takes a lot more than an ad campaign; it requires a consistent approach in every channel, encompassing multiple products and services, and individualizing service to customers in the way that feels meaningful to each one.

It isn't effortless, and few customers feel their bank succeeds.

Except for credit union members. A recent Gallup study finds that credit unions are far better at supporting their members' feelings of wellbeing than banks are.

Consequently, credit union leaders can be forgiven for feeling frustrated with this new financial wellbeing trend among banks. Caring about and supporting financial wellbeing has traditionally been a focus -- and competitive advantage -- for credit unions. Retail banks are clearly encroaching on a key credit union strength and differentiator, with little evidence of achieving the ambitious goal.

But Gallup research shows how retail banks -- neo banks, too -- could improve the perception of financial wellbeing with their customers and finally close the "customer-care gap" that credit unions have long enjoyed.

Banks and credit unions deliver different levels of wellbeing support.

Engineering and delivering wellbeing products and services that work -- as far as bank customers are concerned -- is not impossible. Under some circumstances, bankers do it now: Gallup analytics show that customers who have faced a financially disruptive event such as divorce or the death of a spouse are the most likely to feel their banks support their financial wellbeing. Evidently, when a customer's life is at its worst, a bank is at its best.

However, credit unions appear to be at their best far more often than banks. Gallup's research shows meaningful differences between customers and members regarding perceptions of the financial wellbeing support their institutions offer.

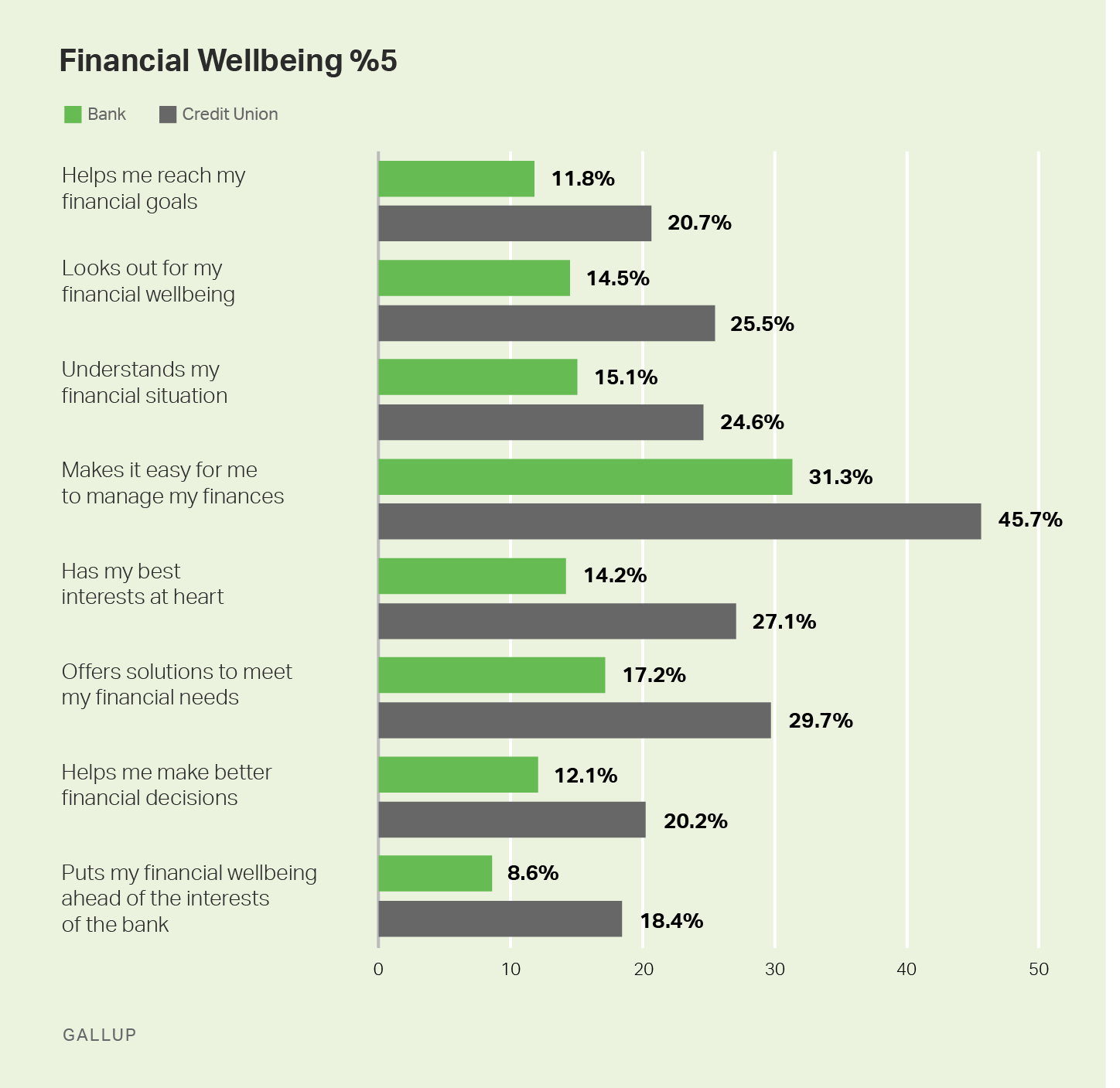

There are gaps between customer and member experiences on every financial wellbeing item, and that's meaningful. High agreement with the statements used to assess financial wellbeing correlates to greater engagement, higher NPS scores and greater share of wallet.

However, the biggest gaps between banks and credit unions -- on items "makes it easy for me to manage my finances," "has my best interests at heart," and "offers solutions to meet my financial needs" -- are meaningful as well. They indicate where banks' financial wellbeing initiatives are falling short.

Here's why.

Credit unions have built strong member relationships by using a personal approach, thoughtful products and member-centric service models to help members manage their finances -- and 46% of members strongly agree their credit union does.

How banks can adopt the credit union approach.

The credit union business model and member-centric ethic also enhance members' belief that the credit union has its members' best interests at heart. This all adds up to help credit unions create better perceptions of financial wellbeing support among their customers.

The feeling credit union members enjoy -- of being cared for and looked after by trusted advisers -- is real. It's not marketing. To generate the same perception among their customers, banks have to do what credit unions do: seek to understand their customers' definition of wellbeing.

Very few do.

Customer agreement with statements like, "makes it easy for me to manage my finances," "has my best interests at heart," and "offers solutions to meet my financial needs" are in the most need of shoring up, but all customers exist in their own financial context. Bankers must understand that context to support the individual's wellbeing.

And bankers should be highly conscious of the danger of failing, too. The best-case scenario: customers will feel like financial wellbeing is an empty slogan, and the bank will have wasted some percentage of its product development and marketing dollars.

The feeling credit union members enjoy -- of being cared for and looked after by trusted advisers -- is real. It's not marketing.

Worst-case scenario: customers will feel lied to or manipulated. As fewer than one in three Americans have "quite a lot" or a "great deal" of confidence in banks, customer trust can't be assumed. And because perception of financial wellbeing can be so deeply emotional, even visceral, banks should not toy with their customers' feelings. A customer who loses faith in promised support for financial wellbeing may be liable to lose faith with the bank entirely.

This is not to say banks should forgo a financial wellbeing value proposition -- just that they should be careful. Developing a feeling of real financial wellbeing in customers can be done, as credit unions and banks sometimes demonstrate.

And banks have their own competitive advantage to leverage: their financial, staffing and technological scope and scale. All of it could be employed toward fulfilling a financial wellbeing value proposition, as long as it includes the type of deep customer knowledge that credit unions have used so well. Until banks use their resources to support customer wellbeing, credit unions will be the place people go to feel cared about -- and all the ads in the world won't change that perception.

Learn how you can deliver on your bank's promise for financial wellbeing:

- Drive organic growth through a human-centered approach with Gallup's financial services experts.

- Partner with Gallup and help your customers thrive in their financial wellbeing.

- Approach your customers' financial wellbeing with a new strategy and measure their engagement.